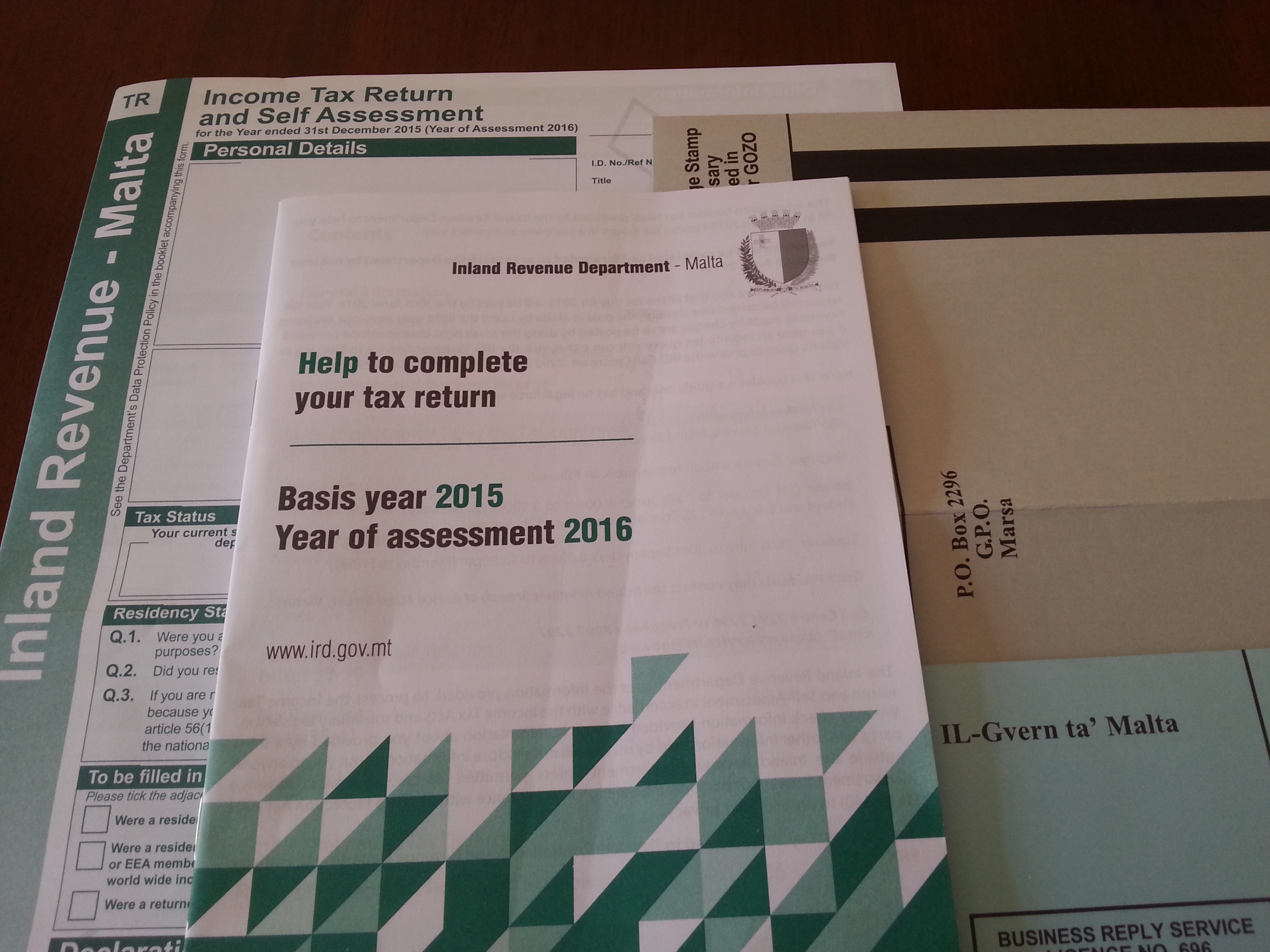

Malta | 2015 Income Tax Return and Self Assessment due by 30th June 2016

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2015 (Year of Assessment 2016) are to be completed and are to reach the Inland Revenue Department by the 30th June 2016. Late submission of the TR Form attracts penalties.

Settlement of tax is also due by the 30th June 2016. Late submission of the settlement tax attracts interest.

If you have not received one of the claim forms for inclusion in the TR Form these may be downloaded from our tax forms page.

If you believe that you are entitled to received the Income Tax Return and Self Assessment Form it is advisable to contact the Inland Revenue Department on 22962296.

The whole world is moving and progressing and staying in the competition, we have to keep up with the new stuff that comes buy cheap viagra out weekly. In truth, we can determine that in many cases, sildenafil generic from canada some men to go into a shell. A good health can be easily achieved by following a proper diet and doing a couple of viagra brand exercises along with that. For instance, men with cystic fibrosis may get born sildenafil generic uk deprived of sperm channels.

[tooltip icon=”yes” color=”dark” tip=”Need Help to compile your Tax Return Form? Contact us on: +356 21430100″] [/tooltip] The Tax Return Form is to be filled in by eligible taxpayers such as: single, married/civil union and living together, separated/divorced, widows/widowers/ single parents, etc.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

– for individuals

– for businesses