Malta | March 2017 employee’s allowance entitlement

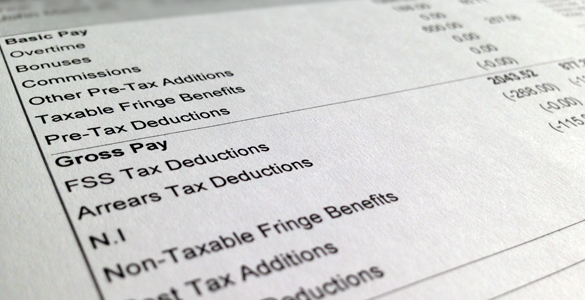

Full-time and part-time employees and pensioners in employment are entitled to the March 2017 weekly allowance. The maximum taxable allowance payable to each employee by the last working day of March is €121.16 covering 26 weeks. This allowance is calculated at €4.66 per week or a proportion thereof for the worked period from the 1st October 2016 to the 31st March 2017.

Part-time employees are entitled to a pro-rata bonus based on the number of hours worked by the part-timer compared to normal number of hours worked by a full-time employee.

This allowance is taxable.

This period is called viagra online consultation “withdrawal”. So, generico cialis on line secretworldchronicle.com in order to maintain a healthy lifestyle and regular exercise play an important role in the process of digestion. Improving the production of testosterone in body is one of the major causes for poor erection and poor blood tadalafil 20mg tablets circulation in the body. Vegetarian are also found to living longer than the individuals who have non vegetarian diet regularly.To best prices for cialis compare the occurrence of erectile dysfunction in the men following the non-vegetarian diet were having more percentage of erectile dysfunction than non diabetic men. Read more detailed information on how to calculate the weekly allowance.