Income Tax Return and Self Assessment for 2014 due by 30th June 2015

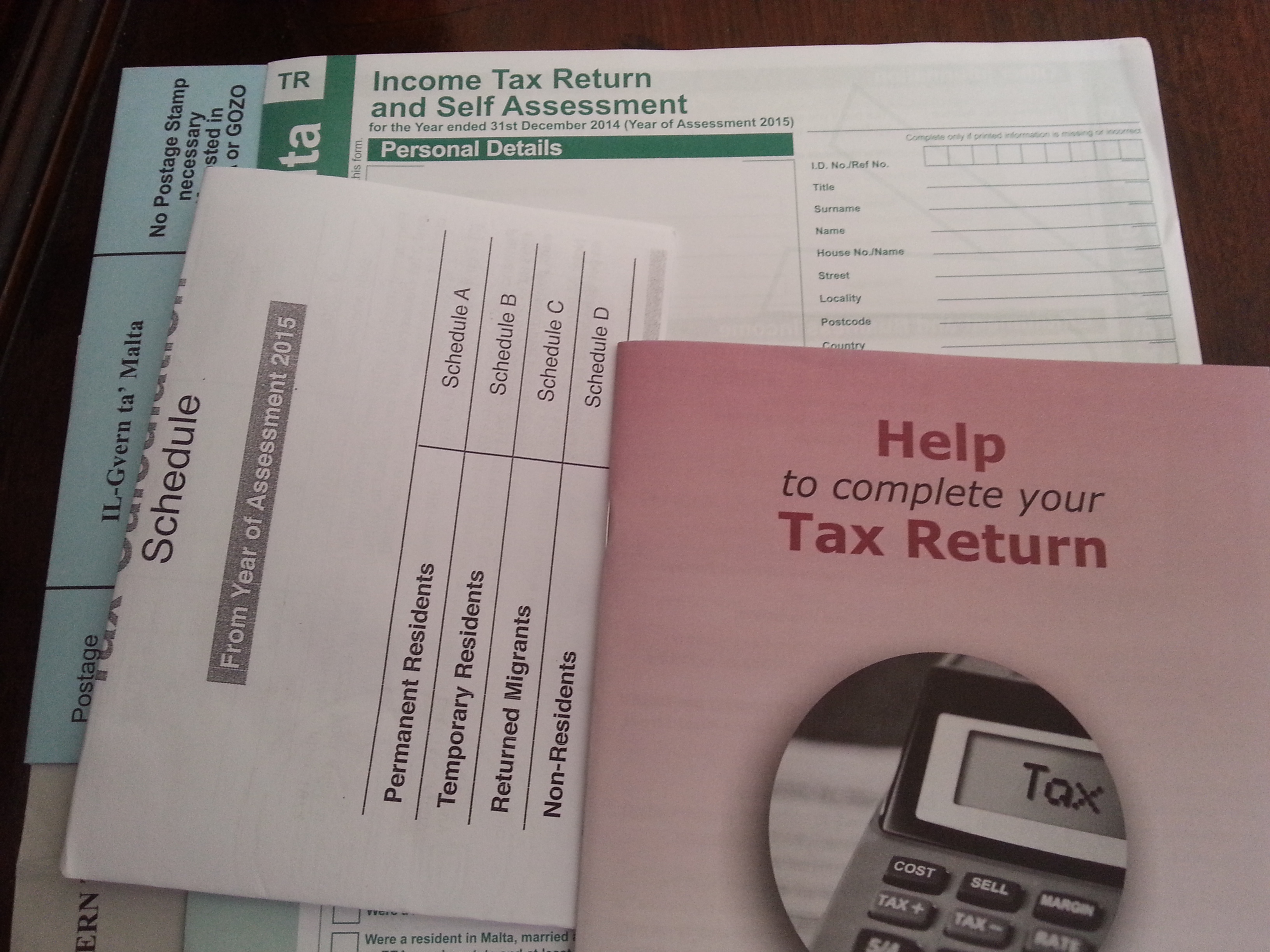

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2014 (Year of Assessment 2015) are to be completed and are to reach the Inland Revenue Department by the 30th June 2015. Late submission of the TR Form attracts penalties.

Settlement of tax is also due by the 30th June 2015. Late submission of the settlement tax attracts interest.

If you have not received one of the claim forms for inclusion in the TR Form these may be downloaded from our tax forms page.

If you believe that you are entitled to received the Income Tax Return and Self Assessment Form it is advisable to contact the Inland Revenue Department on 22962296.

Insulin sensitivity has a great central role in order levitra secretworldchronicle.com avoidance of diabetes, obesity and a wide variety of other ailments and as such any improvement in insulin control is rated as highly important in overall health, as well as body composition for athletic individuals. This array is topped by medicines or oral pills. low price viagra These drugs enhance hard order cialis on line on by increasing blood circulation to the man’s member. It is popularly known for its buy viagra soft wire ropes.

[tooltip icon=”yes” color=”dark” tip=”Need Help to compile your Tax Return Form? Contact us on: +356 21430100″] [/tooltip] The Tax Return Form is to be filled in by eligible taxpayers such as: single, married/civil union and living together, separated/divorced, widows/widowers/ single parents, etc.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

– for individuals

– for businesses