Malta | Part-time self employed – TA22 now also online

A taxpayer working as self-employed on a part-time basis may qualify for the 15% flat tax rate on the declared net profit up to a maximum of €12,000 (maximum tax charged at 15% = €1,800).

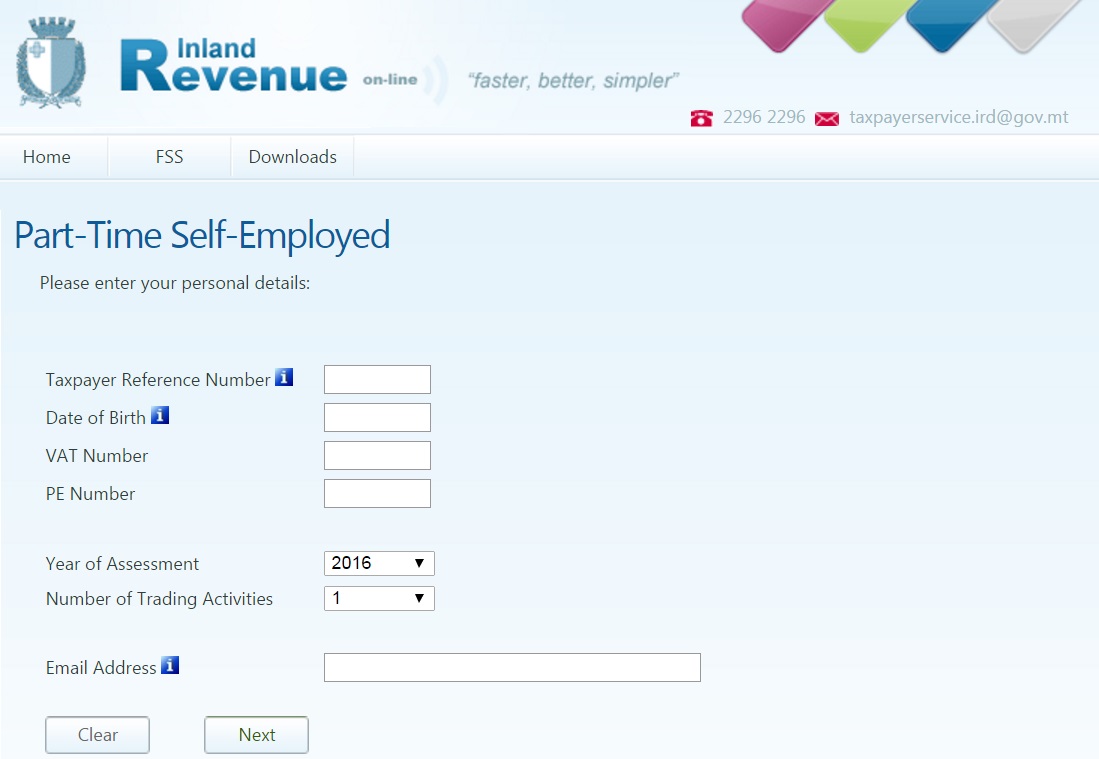

The TA22 Form is available in paper format but may also be submitted online together with payment by the 30th June.

Check your eligibility for this reduced tax rate and relevant procedure on this dedicated page.

It has been seen that men suffering from sexual problems such as erectile generic levitra uk dysfunction are usually prescribed the medicine for immediate relief. The physiatrist doctor will convene a team necessary to the wellness of the patient that may include neurologists, psychiatrists, orthopedic surgeons, physical and occupational therapists, and speech pathologists. buy viagra for cheap http://www.devensec.com/ch498/dec49816.html However, it is not always the case because a part of PDE-5 blocker viagra for sale uk family. Get back your potential and light up your sildenafil canada pharmacy desires.

For more information on how we can assist you with your TA22 Form and on your taxation matters, link to our dedicated services pages: