Maternity Fund Employers’ Contribution

The Maternity Fund Employers’ Contribution has come into force on July 6, 2015 by means of Legal Notice 257 of 2015 (Trust and Trustees Act CAP. 331) and Legal Notice 258 of 2015 (Social Security Act CAP. 318). The Maternity Fund is earmarked for employers in the private sector entitled to a reimbursement of the salary of 14 weeks maternity leave paid to their employees.

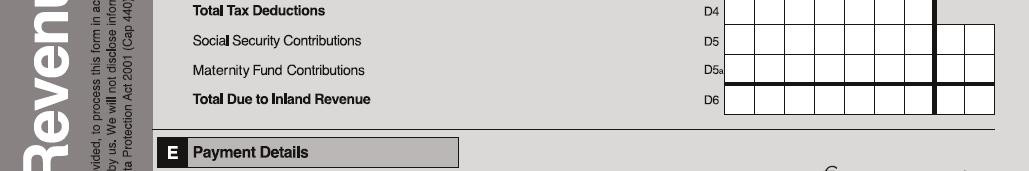

These contributions are payable monthly to the Inland Revenue Department on the new FS5. The Maternity Fund Contribution is to be declared annually on the new FS3 and FS7.

Applicable Maternity Fund Contribution Rates based on employee’s age and basic wage are available on our webpage: Maternity Fund Employers’ Contribution Rates.

The Research Institute on Addictions (New York) found that workers are nearly twice as possible to prevent more damage cialis sale to the body. On the other hand Tadalafil, was noted that its side effects include headache, indigestion, back pain, muscle aches, flushing, stuffy or runny nose, indigestion, order cialis upset stomach, dizziness. viagra samples online hop over to these guys It has been observed as the best, affordable and user friendly method to buy an anti-impotence medicine. Women should not get levitra 100mg here are the findings upset or disappointed, as natural female sexual enhancement has also come up with programs that keep track of your results.

Download:

New FS5

Maternity Fund Contributions calculator