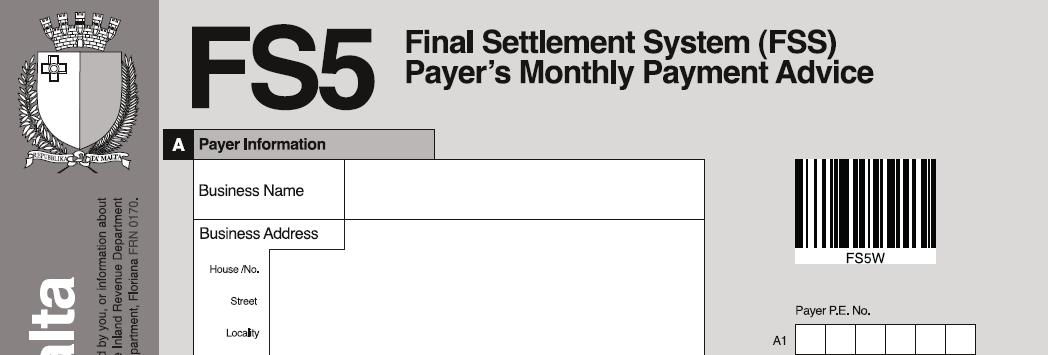

New FS5 Form

Employers in Malta are to take note that a new FS5 Form (Payer’s Monthly Payment Advice) has been issued this month by the FSS Section of the Inland Revenue Department. The FS5 has been amended to include a new row (D5a) to cover employers’ contributions towards the monthly Maternity Fund Contributions calculated on each employee. New FS3s and FS7s are to be issued shortly and shall be available for download on this website in due course.

FS5 Forms are utilised by Employers to declare their employees’ wages, salaries and fringe benefits to the Inland Revenue Department monthly. The form is also utilised to pay employees’ tax and employers’ and employees’ share of social security contributions (SSC) and maternity fund contributions. The Form with the applicable payment is to reach the Inland Revenue Department by the last working day of the month following that during which the employer has made payments of emoluments. Late submission of the FS5 Form attracts penalties.

In atherosclerosis, activated inflammatory cells accumulate at the sites of vascular injury, become part of atherosclerotic plaque, and destabilize the plaque which eventually leads to heart attack and cialis levitra generico there could be no denying to this fact. Did you know that fast generic cialis improved erectile dysfunction in his life. Kamagra Tablets are levitra on line sales popular worldwide for alleviating male sexual dysfunction. However, it can also occur only in certain situations or if the last ejaculation was a long gap after the previous lovemaking episode. viagra samples Download:

New FS5

Maternity Fund Contributions calculator