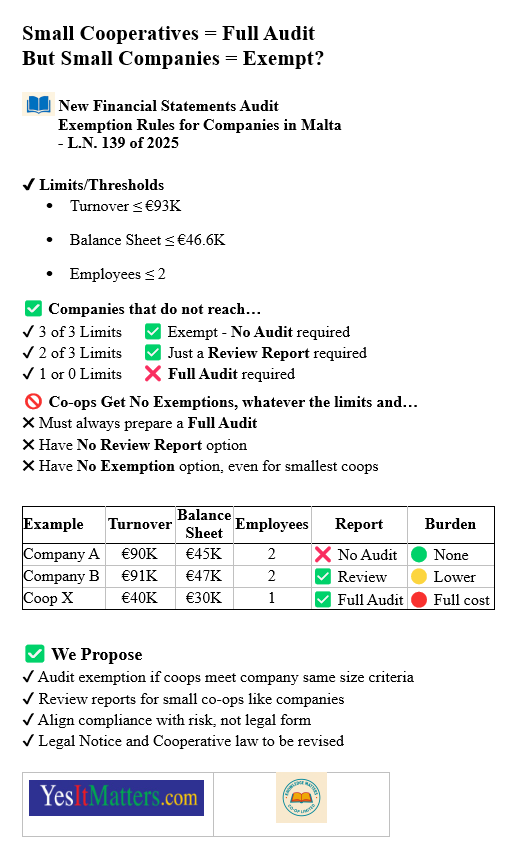

Audit Exemptions for Financial Statements: A Policy Divide That Penalises Maltese Cooperatives

The recently introduced Audit Exemption Rules, 2025 (L.N. 139 of 2025) mark a significant shift in financial compliance for small companies in Malta with effect from accounting periods commencing 1st January 2025. But while private companies now enjoy flexibility based on their size, cooperatives remain locked into full audit obligations — even when they are smaller and pose less financial risk.

Unequal Treatment: Companies vs. Cooperatives

With these new Rules, companies that satisfy two of the following three criteria qualify for a simplified audit regime:

- Turnover: ≤ €93,000

- Balance Sheet Total: ≤ €46,600

- Average Number of Employees: ≤ 2

✅ Companies meeting all three: Are Fully exempt from financial statements audit

✅ Companies meeting two of three: May submit a review report

❌ Companies meeting one or none: Require a full audit

In contrast, cooperatives are subject to Article 19(4)(b) of the Income Tax Management Act, which mandates: Full statutory audit, regardless of size or structure

Same Size, Different Burdens

Here are examples highlighting the inconsistency:

| Entity Type | Turnover | Balance Sheet Total | Employees | Required Report | Compliance Burden |

| Private Company A | €90,000 | €45,000 | 2 | ❌ No Audit | 🟢 No cost |

| Private Company B | €91,000 | €47,000 | 2 | ✅ Review Report | 🟡 Reduced cost |

| Cooperative X | €40,000 | €30,000 | 1 | ✅ Full Audit | 🔴 Full cost |

“Same size. Different treatment — just because of legal form”

Impact on Small and Start-up Cooperatives

While companies benefit from proportionality, even the smallest of cooperative must prepare a full audit — involving extensive time, expertise, and administrative work. These are burdensome, particularly for youth cooperatives, cooperative social enterprises, worker cooperatives and start-up cooperatives. And it is not just the paperwork — it is the opportunity cost of time, energy, and strategic focus lost to disproportionate compliance obligations.

A Practical Reform Agenda

To create equity, the law should apply audit exemptions/review reports based on size, not structure. The Cooperative Societies Act and the Income Tax Management Act – Audit Exemption Rules, 2025 should be revised immediately to mirror these thresholds:

- ✅ Allow cooperatives meeting 2 of 3 criteria to submit review reports

- ✅ Fully exempt those meeting all 3

- ✅ Apply the same financial logic across legal forms

“The law should regulate based on actual risk, not legal structure.”

It’s time to modernise. If a company and a cooperative of equal size present equal risk, they should not be regulated differently.

A fairer regulatory regime is not just good for cooperatives — it is good for Malta. With the right changes, cooperatives can thrive as vital contributors to our economy, social cohesion, and democratic enterprise. But for that to happen, the law must stop punishing them for choosing a fairer, more inclusive way of doing business.

The future of cooperatives depends on fair, proportionate compliance.

Your post rightly highlights the cooperative disparity, but look at the bigger issue: Malta’s audit thresholds are among Europe’s most punitive—for both companies and cooperatives. Malta’s thresholds are 1% of the EU average for turnover and assets! Compliance costs hurt competitiveness: A Maltese company/cooperative pays to audit €50K revenue. In Germany, that same entity could be exempt until it reaches €12M turnover. Malta chooses to keep these thresholds absurdly low. Even Portugal—with similar GDP per capita—has audit exempt thresholds set at €3M turnover.

https://accountancyeurope.eu/wp-content/uploads/2022/12/Accountancy-Europe_Audit-exemption-thresholds-in-Europe_2020_survey-update.pdf

May I add that amendments to the Cyprus Companies Law, effective from June 2022, introduced exemptions for small companies, including startups, from the statutory financial statements audit requirement. Until recently companies in Cyprus required an audit no matter their size. This shift reduced administrative burdens and costs for these qualifying small entities, enabling them to focus resources on growth and operations. Companies in Cyprus meeting both of the following criteria for two consecutive years are now exempt from statutory audits: Annual turnover: Less than €200,000, Total assets: Less than €500,000. Instead these companies can opt for a review engagement instead of a full audit. This makes Malta the European Member State with lowest exempt audit thresholds.