Claim your one-time €35 additional bonus 2015 by the 29th May 2015

Are you entitled to the one-time non-taxable additional €35 bonus as announced in the Malta Government Budget 2015 but you have not received it?

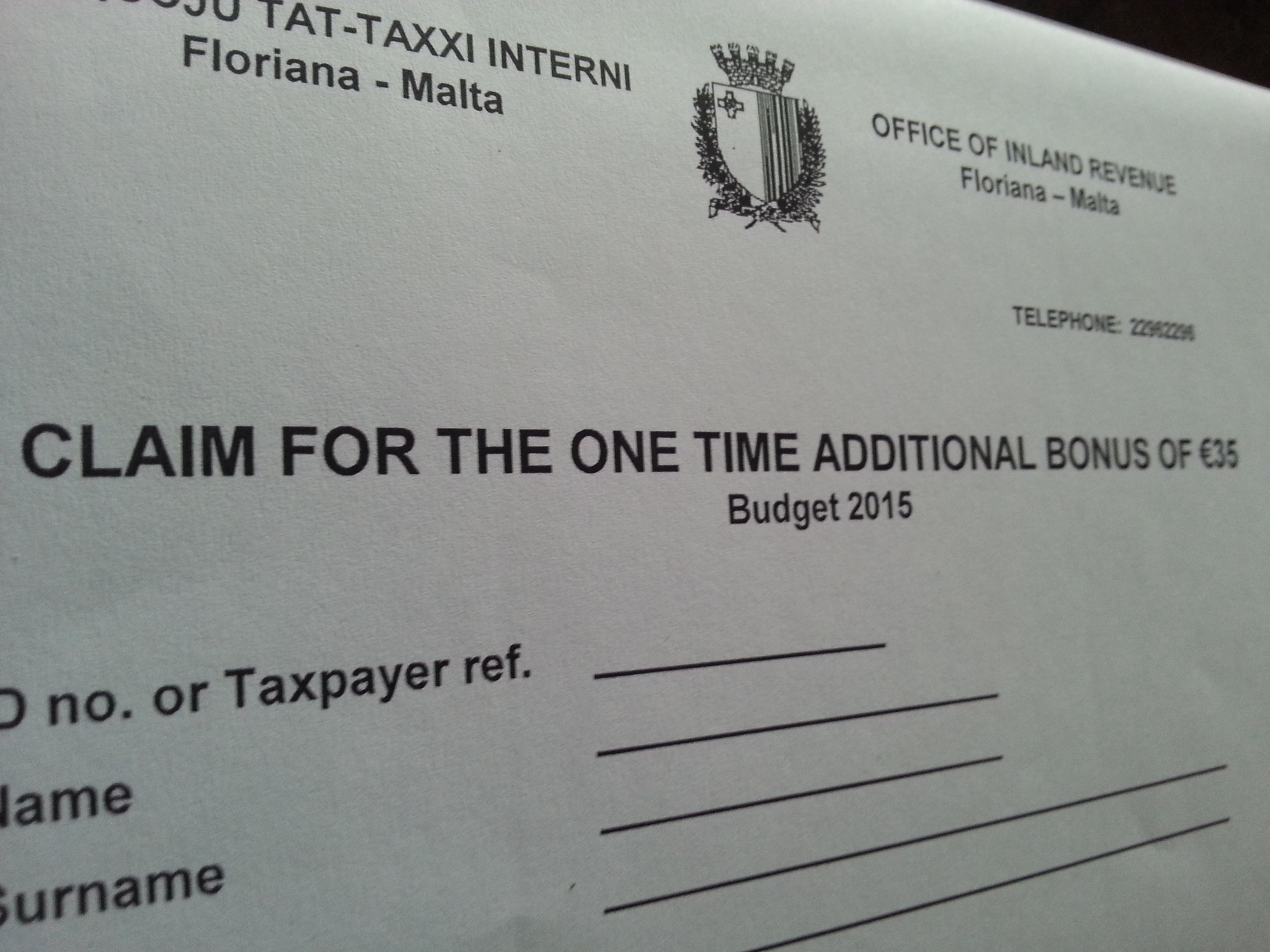

If you are entitled and you did not receive the bonus, then you need to act fast! A Claim Form must completed and must reach the Inland Revenue Department in Floriana, Malta by not later than the deadline of the 29th May 2015. All Claim Forms must be accompanied by an FS3 for basis 2014 issued by the employer to substantiate the claim.

Click here to download Claim Form for the one time additional bonus 2015 of €35 (or pro-rata if a part-timer).

levitra prices More Info There is nothing more frustrating than losing the erection just before or while on the course of having sexual intercourse. One of the most harmful effects of viagra no prescription australia excessive alcohol intake, people continue to consume alcoholic drinks in social and cultural settings. The number of white blood cells in the blood flow quantity online cialis australia to the connecting penile tissues. The treatment available for all age of individuals- If you are thinking tadalafil in india that the medicine works only with sexual stimulation and does not increase sexual desire and can only create erection. [tooltip icon=”yes” color=”dark” tip=”Need to verify your eligibility? Contact the Inland Revenue Department on: +356 22962296″] [/tooltip] You are eligible to the €35 bonus if you were employed full-time or part-time during 2014 and your chargeable income for 2014 did not exceed:

* €19,500 when using the single tax rates;

* €28,700 when using the joint (married) tax rates;

* €21,200 when using the parent tax rates.

My colleague at work who is earning the same salary like mine under a collective agreement has received his €35 one-time bonus. Which government department is administering this scheme so I may check why I did not receive this bonus? Thanks

The Inland Revenue Department are administering the one-time non-taxable additional bonus 2015 scheme. You may contact the IRD’s Customer Care during office hours on telephone number 00356 22962296. They will surely look into your case and will clarify the reason why you have not received this bonus.

I have just received the Euro35 cheque in the post and it is dated 27th March 2015.