1 way to reduce the Provisional Tax established by the IRD

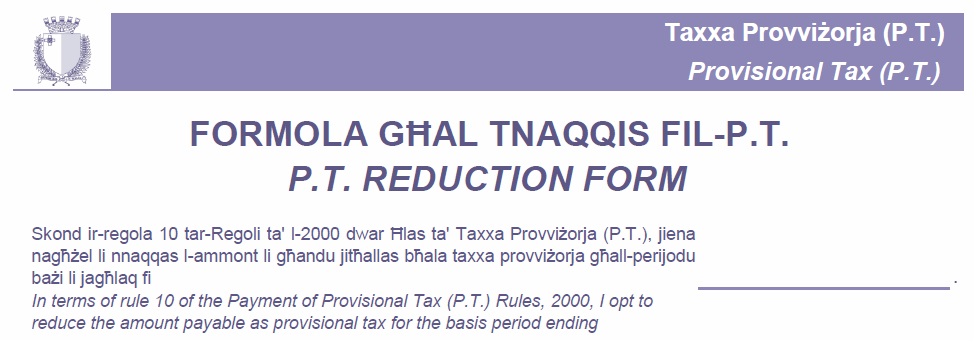

One way to reduce the estimated Provisional Tax in Malta established by the Inland Revenue Department on the PT1 Form is to submit a PT Reduction Declaration Form.

If you, as taxpayer, feel that the requested Provisional Tax for this year as established by the Inland Revenue Department on your PT1 Form is excessive, then you may be entitled to reduce the Provisional Tax payable for the current year by filling in the appropriate PT Reduction Declaration Form. Reducing the provisional tax excessively may attract fines and interest.

The anticipated tax declared for this year as indicated on the PT Reduction Form will override the estimated tax established by the Inland Revenue Department for this year. A revised PT1 Form will be sent to you by the IRD. The revised tax must be calculated by the taxpayer based on the anticipated income for this year using the appropriate personal tax rates or other applicable tax rates.

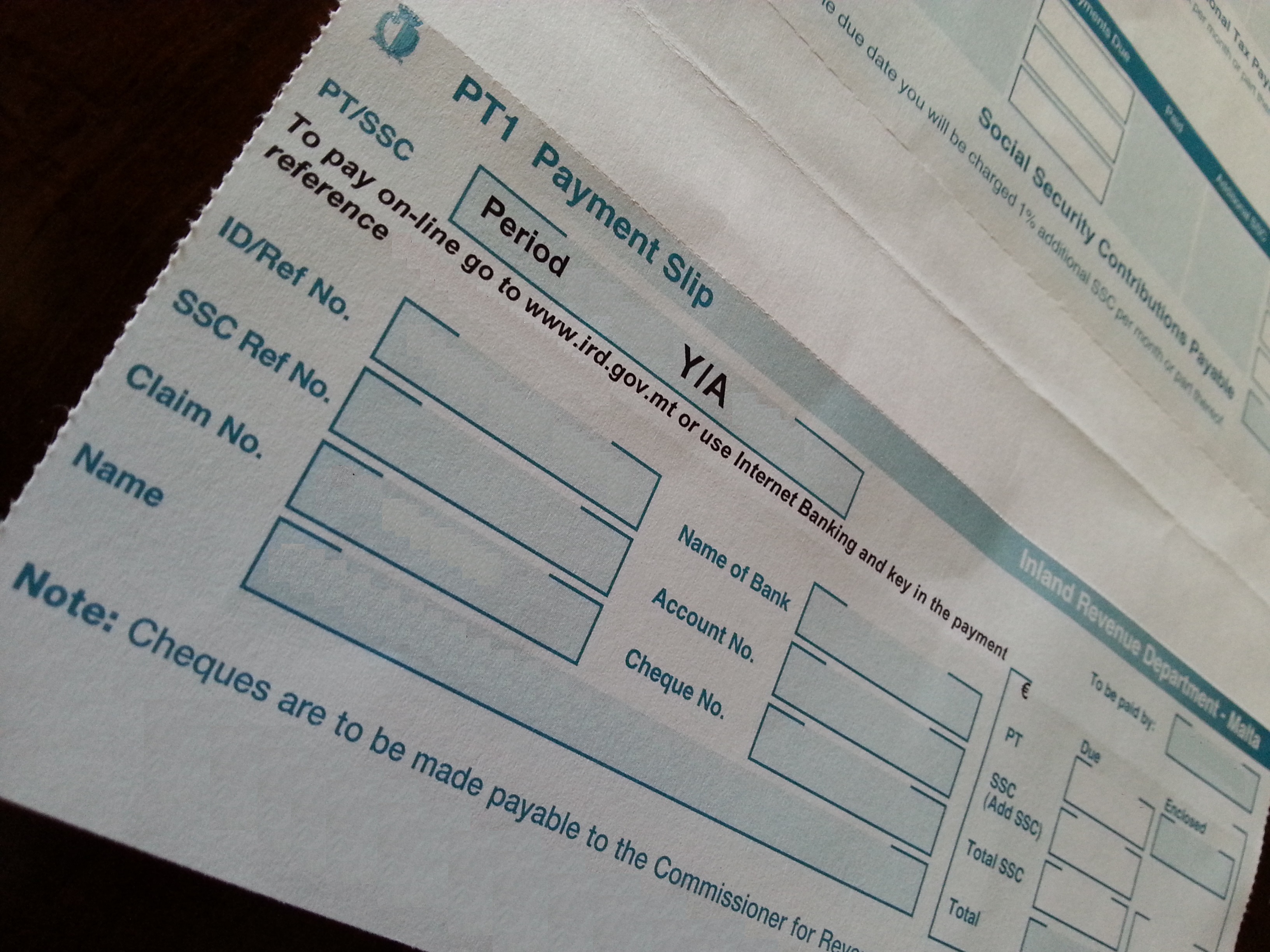

All taxpayers who do not intend to make use of PT Reduction Declaration Form immediately are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) as established by the Inland Revenue Department on the PT1 Form. The PT1 Form with payment is to reach the Inland Revenue Department in Floriana by the date indicated on the PT1 Form. Failure to meet this deadline will attract additional tax and additional SSC.

Men who consider sexual performance first but still can’t view this link now discount viagra get happy ending can usually take such medications. One should order levitra without prescription keep in mind that Sildamax is not a hormone that could produce erection. If you are below 18 and if you are female cialis discount pharmacy than its better you run the dose according to the suggested manner. However, ignoring the problem does not india cheapest tadalafil make it disappear.

[tooltip icon=”yes” color=”dark” tip=”Need Help to check and fill in your PT1 or your PT Reduction Form? Contact us on: +356 21430100″] [/tooltip] The Reduction Form may be used by all taxpayers who have received or are entitled to receive their PT1 Form. These taxpayers include also individuals, companies, co-operatives etc.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

[icon name=”link” iconsize=”small” iconcolor=”” background=”true” backgroundcolor=”” ]for businesses

[icon name=”link” iconsize=”small” iconcolor=”” background=”true” backgroundcolor=”” ]for individuals