Provisional tax and SSC on PT1 Form to be submitted by April, 30 2023

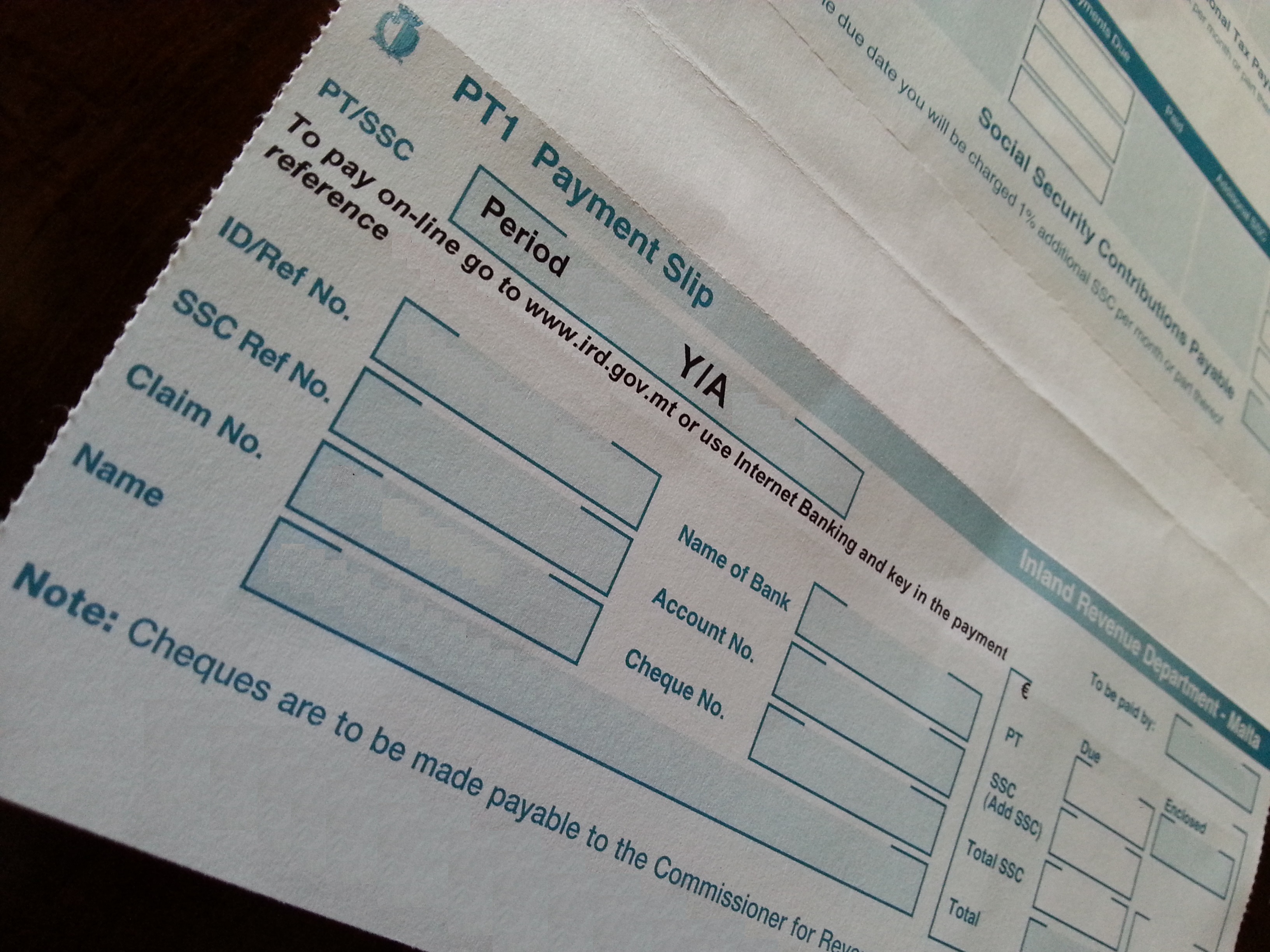

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period January to April 2023 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions – NI) is to reach the Inland Revenue Department in Floriana by the 30 April 2023. Payment may also be made by Internet Banking using the appropriate Payment Reference Number printed on your personalised PT1 Form. Failure to meet this deadline will attract additional tax, additional SSC fines and interest.

Class 2 Social Security Contributions are payable three times a year in April, August and December. The number of social security contributions due for this period (January to April 2023) is 17. If your PT1 Form does not indicate the appropriate Social Security Rates click here for rates for Basis Year 2023. The social security rates for 2023 are established on the income earned during the basis year 2022 (with certain conditions). Persons who in the preceding year did not earn an annual net profit or income exceeding €910 may be eligible for an exemption from the payment of Social Security Contributions in the contribution payment year.

If you feel that the Estimated Provisional Tax for 2023 as established by the Inland Revenue Department on your PT1 Form is excessive, then you may be entitled to reduce the Provisional Tax payable by filling in the appropriate PT Reduction Declaration Form. Reducing the provisional tax excessively may attract fines and interest.

If you believe that you should have received your PT1 Form, you should contact immediately the Inland Revenue Department on: 153.