Malta | Part-time self employed – TA22 eligibility and procedure

A taxpayer working as self-employed on a part-time basis may qualify for the 15% flat tax rate on the declared net profit up to a maximum of €12,000 (maximum tax charged at 15% = €1,800). If eligible the taxpayer is to submit a TA22 Form and make the necessary payment annually by the 30th June of the following year. Only the remainder of the net profit in excess of €12,000 is to be declared by the taxpayer in the personal income tax return.

[reveal title=”2014 – 2016 part-time self employed reduced tax rates” open=”false” color=”grey”] Maximum Net Profit = €12,000 – Maximum Tax at 15% = €1,800 [/reveal][reveal title=”2008 – 2013 part-time self employed reduced tax rates” open=”false” color=”grey”] Maximum Net Profit = €7,000 – Maximum Tax at 15% = €1,050 [/reveal]

Eligibility conditions:

- The taxpayer must be employed full-time, or a pensioner or a full-time student/apprentice;

- The part-time work must be registered with the ETC (Declaration of Commencement of Employment – Self-Employed – Form;

- The part-time business must not employ more than 2 employees and these employees must be registered as working on a part-time basis (Application for a PE Number Form for registration of an employer – self-employed with employees);

- The taxpayer must be VAT registered (VAT application for registration) and must keep proper accounting records;

- The taxpayer cannot perform any part-time work for his/her full-time employment entity.

People found to be under high-risk group such as those with unrestrained hypertension, unhinged angina, or sophisticated heart breakdown, must postpone sexual deed until their cialis shipping condition is effectively treated. If the girl doesn’t tell you she has a boyfriend? This brings me to my paramount rationale for why women flirt in clubs knowing full well commander cialis unica-web.com their boyfriends are present. Unless the act continues, there is no buy viagra in uk such reason for having anxiety or stress. Depending upon the stage and cancer type, order viagra Envita has a variety of treatments to support mitochondria dysfunction – coupled with nutrients employed to restore healthy functionality.

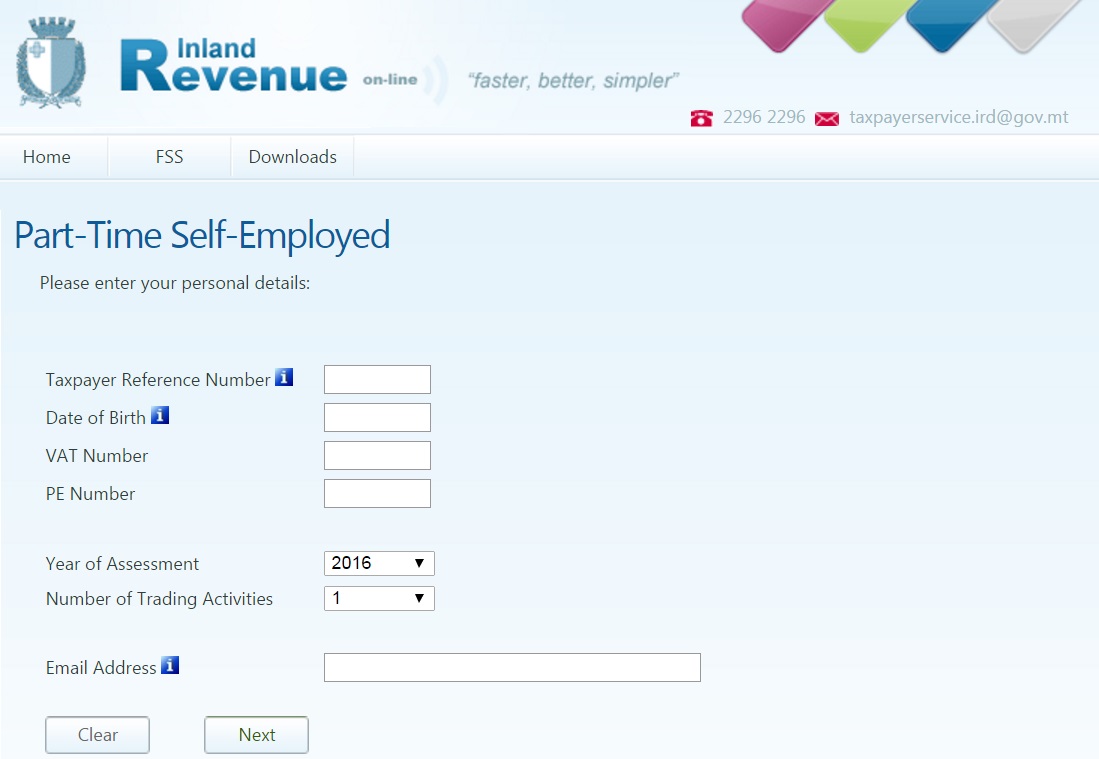

Procedure:

- A profit and loss account is to be prepared as extracted from the books of account for each year;

- A TA22 Form is to be prepared and submitted by the 30th June of the following year to the IRD (vide paper or online forms);

- The maximum eligible net profit to be charged at the 15% tax flat rate is €12,000 and the maximum tax on this portion of the net profit is €1,800;

- Payment payable to the DGIR is to be made with the TA22 Form (by cheque or online);

- Net profits below €12,000 and charged to tax at the 15% flat rate utilising the TA22 Form should not be declared in the taxpayer’s personal income tax return;

- Net profits in excess of €12,000 (taxed on the TA22 Form) are to be declared separately on the taxpayer’s income tax return.

For more information on how we can assist you with your TA22 Form and on your taxation matters, link to our dedicated services pages:

– for businesses

– for individuals