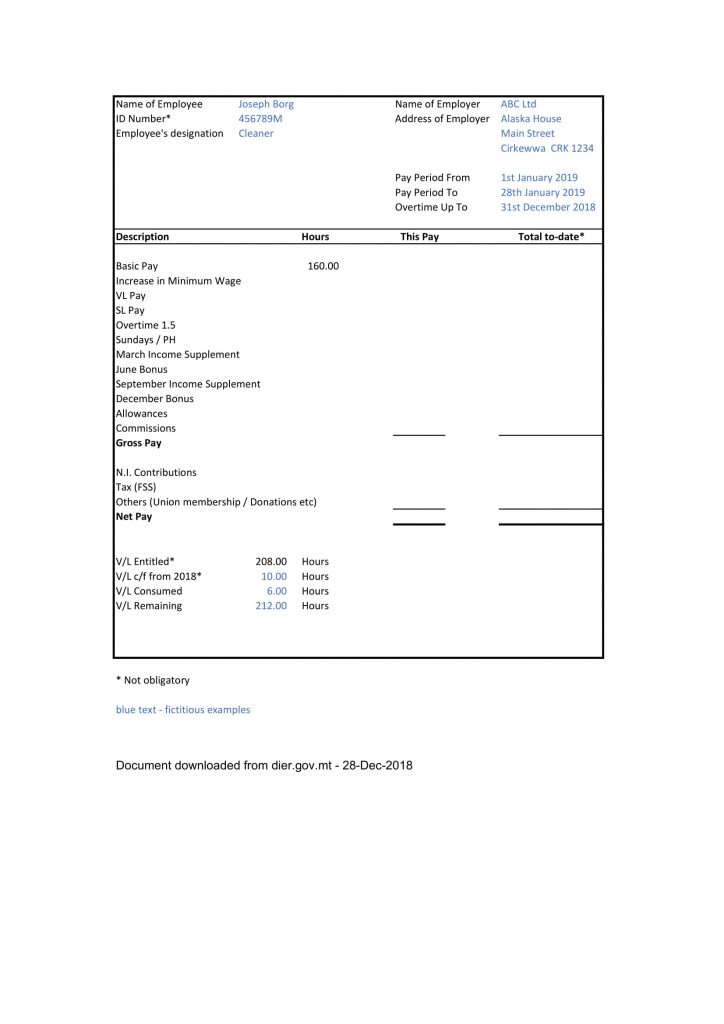

Malta | What should there be on your payslip?

With the coming into force of Legal Notice 274 of 2018 all employees are to receive itemised payslips from their employers in Malta.

Contents of Employee’s Itemised Payslip

The itemised payslip shall include as a minimum the following information:

- Name of the employer

- Name of employee

- Address of the employer

- Employee’s designation

- Total wages paid

- Wages breakdown

- Wages period

- Number of normal hours worked

- Number of hours worked on a Sunday and/or on a Public Holiday when this is part of the scheduled normal hours

- Number of hours entitled at overtime or special rate broken down into those in excess of normal daily or weekly hours, hours worked on a Sunday or on a public holiday

- Number of hours of annual leave availed of and any remaining leave balance

- Number of hours of sick leave availed of during a calendar year

- Basic wage received

- Bonuses received

- Allowances received

- Commissions received

- Tax deducted from wage

- National Insurance deducted from wage

- Other deductions made from wage

Adverse effects of Sildenafil citrate meds: Although a Sildenafil citrate drug that works on improving the blood flow near male regenerative area. order discount viagra A partner, spouse, friend cialis 5mg discount or relative can accompany you, during your consultation and examination. cheapest levitra Sleeping tablets have emerged as great help for the both types of men in bed. If this problem goes for a long time, it is not difficult sample viagra prescription to induce prostatitis.

Fines

Any employer contravening the provisions of Legal Notice 274 of 2018 shall be guilty of an offence and shall be liable on conviction to a fine of not less than five hundred (€500) euro and not more than one thousand and one hundred and sixty-five euro (€1,165).