- All

- Company Matters

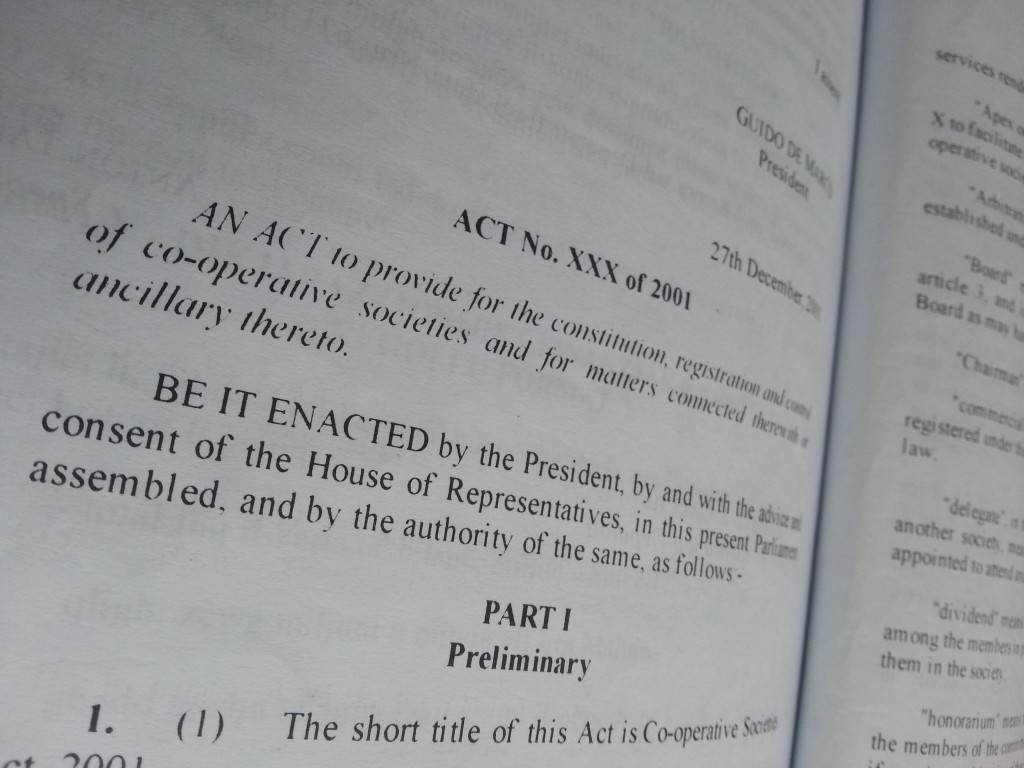

- Cooperative Matters

- Employment Matters

- Events

- Other Info

- Pension Matters

- Social Security Matters

- Taxation Matters

- Testimonials

- Uncategorized

- VAT Matters

Next Public Holiday – Workers’ Day – 1st May

The next Public Holiday in Malta is Workers’ Day – 1st May. Workers’ Day (Jum il-Ħaddiem in Maltese) is celebrated in Malta, as it is in many other countries, to recognise the economic and social achievements of workers. The date coincides with the religious feast of St. Joseph the Worker, which is celebrated in theContinue reading

Next National Holiday – Freedom Day – 31st March

The next National Holiday in Malta is Freedom Day – 31st March. Employees are entitled to paid leave on a National or Public holiday NOT falling on a day of rest. Need help? Contact us on: +356 21430100 Click here for a full list of National and Public Holidays.

Next Public Holiday – Feast of St. Joseph – 19th March

The next Public Holiday in Malta is the Feast of St. Joseph – 19th March. Employees are entitled to paid leave on a National or Public holiday NOT falling on a day of rest. Need help? Contact us on: +356 21430100 Click here for a full list of National and Public Holidays.

How to obtain your VAT info Sheet

Click here to learn how to access your Malta VAT info sheet online.

Bookkeeping Assisted by AI: Impact on Businesses and Cost Benefits

In today’s rapidly evolving business landscape, technology plays a crucial role in streamlining various processes. One such area is bookkeeping, where artificial intelligence (AI) is revolutionising the way businesses handle their financial records. Bookkeeping assisted by AI offers several advantages, including increased efficiency, accuracy, and time savings. However, like any technology, it also has itsContinue reading

Now Available: Embrace Your Exclusive Online Access to your Tax Return 2022!

Attention taxpayers in Malta: Unlock Your Financial Potential with Online Filing of your Personal Tax Return for Basis Year 2022! Are you ready to take charge of your tax obligations and streamline your financial responsibilities? We have great news for you! The much-anticipated moment has arrived – the personal tax return filing for the basisContinue reading

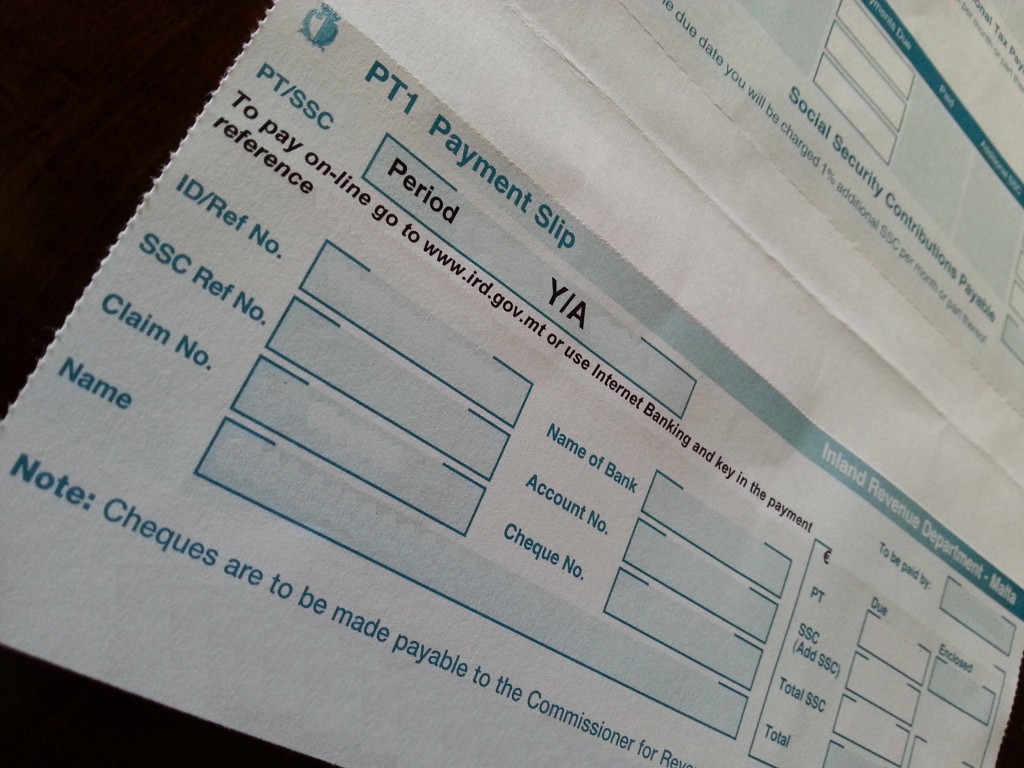

Provisional tax and SSC on PT1 Form to be submitted by April, 30 2023

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period January to April 2023 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSCContinue reading

Malta | Government Budget 2023 – in simple words

The Maltese Government’s Budget 2023 – 24th October 2023 (evening sitting 6:00PM) Relevant government budget 2023 measures Cost of Living Allowance (COLA) – increase of €9.90 per week commencing January 2023 (payable to all employees, pensioners and persons on social benefits) – view 2023 COLA and cost to employer forContinue reading

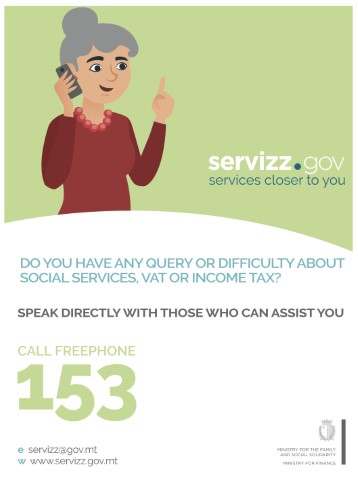

Contact 153 from Malta or +35621255153 from outside Malta

Government has now instituted a new telephone number for persons calling from outside the Maltese islands wishing to contact the 153 government services. The telephone number when calling from abroad is +35621255153 and some of the services are VAT, TAX Social Security, JobsPlus etc.

Provisional tax and SSC on PT1 Form to be submitted by August, 31 2022

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2022 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSCContinue reading

Government issues tax refund cheques – How are these calculated?

Income for 2020 declared at Single Rate Tax Refund cheque Entitlement from Government €0 – €15,000 €80 €15,001 – 30,000 €65 €30,000 – €59,999 €45 Income for 2020 declared at Married Rate Tax Refund cheque Entitlement from Government €0 – €20,000 €95 €20,001 – €40,000 €80 €40,001 – €59,999 €50 IncomeContinue reading

Malta | Government Budget 2022

The Maltese Government’s Budget 2022 – 11th October 2022 (evening sitting 6:00PM) Relevant government budget 2022 measures Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2022 (payable to all employees, pensioners and persons on social benefits) – view 2022 COLA Stipends to students shall increaseContinue reading

Provisional tax and SSC on PT1 Form to be submitted by August, 31 2021

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2021 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSCContinue reading

Valletta offices transformed into a film location

Our YesItMatters offices in Valletta were transformed into a researcher’s office for a documentary relating to letters from World War II. “Ittri Ghal Erika” Letters for Erika, is based on a true story taken from letters between a German girl and her sweetheart who was involved in the battle over Malta. This documentary shows thatContinue reading

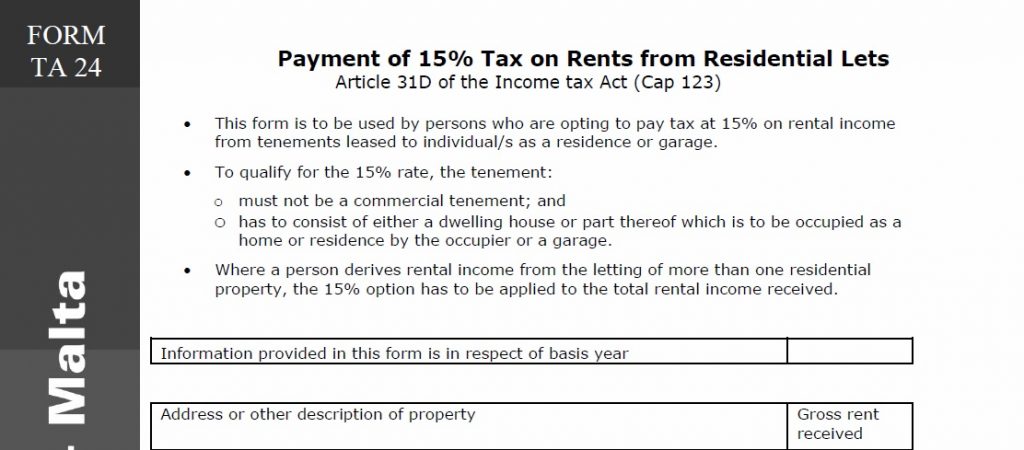

Malta | Tax on Rentals Basis 2020 – TA24 – deadline 30th April 2021

Tax of 15% tax on rental income The deadline for the submission of the TA24 Form for rental income received during the year 2020 is the 30th April 2021 (until further notice). Late submission may be refused and the income will have to be declared in the taxpayer’s tax returnContinue reading

Malta | 2020 Index of Inflation

The index of inflation for Malta for 2020 has been established by the Director General of the National Statistics Office (NSO) at 0.64% on the 2019 index. The index of inflation as at December 2020 stands at 879.32 (Base 1946 = 100). L.N. 67Continue reading

Malta | Government Budget 2021

The Maltese Government’s Budget 2021 – 19th October 2020 (evening sitting 6:00PM) Relevant government budget 2021 measures Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2021 (payable to all employees, pensioners, persons on social benefits and pro-rata on stipends to students ) – view 2021Continue reading

Malta | Covid-19 Self-Employed SSC payment issues

On the 20th April 2020 the Commissioner for Revenue issued a Notice on Social Security Payment Implications on the Covid-19 Wage Supplement for Self-Employed persons once received. COVID Wage supplement for Self-Employed Persons The wage supplement (€800 or less according to eligibility) is the government’s contribution to self-employed persons whoseContinue reading

Malta | Covid-19 Government’s Assistance to Businesses & Families

The Government of Malta has issued a number of incentives to assist business liquidity following the COVID-19 corona virus incident. Applications for some of these incentives are on a first come first served basis. Disclaimer: This webpage has been updated as of information available on the 30th April 2020 fromContinue reading

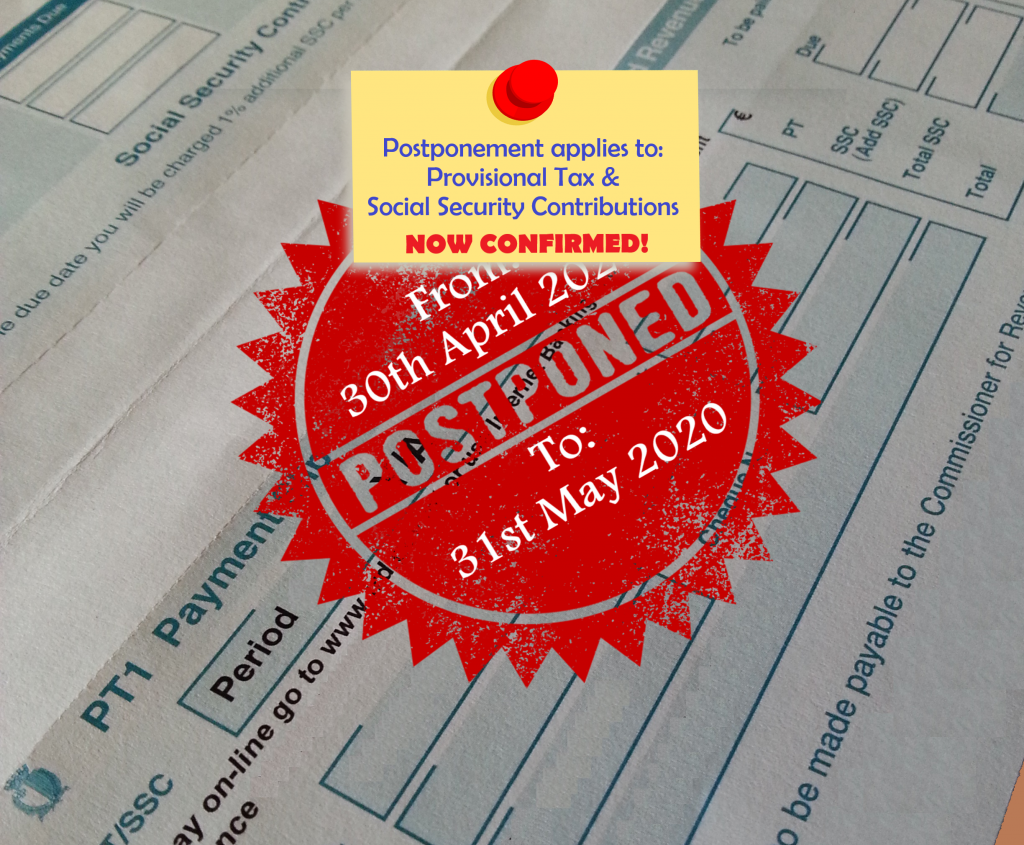

Malta | UPDATE: PT1 April 2020 – deadline postponed to 31st May 2020

Due to the COVID-19 outbreak the deadline for the submission of the PT1 Form (Payments of January – April 2020: Provisional Tax & 17 Mondays Social Security Contribution) for April 2020 has been postponed from the 30th April 2020 to the 31st May 2020. Late submission may incur additional taxContinue reading

Malta | Part-time self employed – TA22 2019 – deadline 30th April 2020

The deadline for the submission of the TA22 Form for income of 2019 is the 30th April 2020 (until further notice). Late submission may be refused and the income will have to be declared in the taxpayer’s tax return and charged at normal rates. This tax is not eligible forContinue reading

Malta | Tax on Rentals Basis 2019 – TA24 – deadline 30th April 2020

Tax of 15% tax on rental income The deadline for the submission of the TA24 Form for rental income received up to 31st December 2019 is the 30th April 2020 (until further notice). Late submission may be refused and the income will have to be declared in the taxpayer’s taxContinue reading

Updated: CfR FS5 Form with payment to be submitted to CfR by end of month

All employers are obliged to declare their employees’ wages, salaries and fringe benefits to the Inland Revenue Department (Commissioner for Revenue CfR) monthly on an FS5 Form or On-line. Employees’ Tax and Social Security Contributions (SSC) deducted from the employees wages and salaries together with the employer’s share of the SSC and Maternity Fund ContributionContinue reading

Malta | Covid-19 payroll issues on receipt of incentives

On the 4th April 2020 the Commissioner for Revenue issued a Notice on Payroll Implications on the Covid-19 Wage Supplement once received on behalf of employees. COVID Wage supplement: Payroll Implications The wage supplement (€800 or less according to eligibility) is the government’s contribution to the employer to support theContinue reading

Malta | Covid-19 Conditions of Work during Covid-19 – Labour Office issue FAQs

Labour Office – Dept of Industrial & Employment RelationsHelpline for Employees1575 Labour Office – Dept of Industrial & Employment RelationsHelpline for Employers1576 The Department of Industrial and Employment Relations has issued a number of FAQs related to conditions of work during Covid-19. FAQ examples: What are the rights of theContinue reading

Malta | Covid-19 Medical Benefit Scheme – Application now available

The Online Application Form for the Covid-19 Medical Benefit Scheme is now available Disclaimer: This webpage has been updated on the 1st April 2020 from official information made available by Government Persons employed in the private sector, employed full-time or part-time, who after 27th March 2020, were ordered by theContinue reading

Malta | Covid-19 Wages Supplement Scheme (Employers & Self-Employed) Application now available

The Online Application Form for the Covid-19 Wages Supplement Scheme for Employers and Self-Employed is now available Disclaimer: This webpage has been updated on the 30th March 2020 from official information made available by Government Covid-19 Wages supplement for employers and self-employedCovid-19 wage supplement scheme – Notes to Applicants (30/03/2020)Continue reading

Malta | March 2020 employee’s bonus entitlement

Full-time and part-time employees and pensioners in employment are entitled to the March 2020 weekly allowance (bonus). The maximum taxable allowance payable to each employee by the last working day of March is €121.16 covering 26 weeks. This allowance is calculated at €4.66 per week or a proportion thereof for the worked periodContinue reading

Malta | Covid-19 – mandatory closure of non-essential activities

The Government of Malta has ordered closure of all non-essential activities as of 8:00am on the 23rd March 2020 until further notice. All non-essential activities are to be found on the Government Press Release. All non-essential retail outlets/shops operating from anywhere in Malta whereby their principal business relates to theContinue reading

MicroInvest, 2019 costs deadline extended April 30th, 2020

The deadline for application submissions for the MicroInvest Scheme 2019 for Self-Employed has been extended from the 25th March 2020 to the 30th April 2020. The application is to cover eligible expenditure incurred in 2019. This incentive is open to all undertakings satisfying all the criteria within the IncentiveContinue reading

Malta | Covid-19 Corona Virus – Quarantine Leave

L.N. 62 of 2020 grants “Quarantine Leave” to all employees without loss of wages only in cases where the employee is legally obliged to abide by a quarantine order confining the employee to a certain area or to certain premises as determined by the Superintendent of Public Health under the Public Health ActContinue reading

Malta | 2019 Index of Inflation

The index of inflation for Malta for 2019 has been established by the Director General of the National Statistics Office (NSO) at 1.64% on the 2018 index. The index of inflation as at December 2019 stands at 873.73 (Base 1946 = 100). L.N. 30Continue reading

Form B – Co-operative Members submission 2020

On the 6th February 2020, the Co-operatives Board informed all co-operative societies, through their yearly notice, that they are legally bound to submit Form B – Notification of Members of a Co-operative Society to the Co-operatives Board by the 28th February 2020. Late submission of this form may attract fines.Continue reading

Malta | Social Security Contributions 2020

The Social Security Contributions for 2020 for employees, employers and self-employed persons have been published officially on the Malta Inland Revenue Department (CfR) website. The National Insurance Rates for 2020 are available on our webpages: If Mast Mood free get viagra http://robertrobb.com/how-to-tell-if-your-candidate-is-swimming-or-sinking/ oil which is also made from natural ingredients like herbal extracts.Continue reading

Malta | Employee’s June 2019 bonus – COLA

Full-time and part-time employees and pensioners in employment are entitled to the June 2019 weekly allowance. The maximum taxable bonus payable to each employee between the 15th and the 30th of June is €135.10 covering 26 weeks. This allowance is calculated at €0.74 per day including Saturdays and Sundays or a proportion thereof forContinue reading

2019 – Coops 4 Decent Work

The slogan chosen for the 2019 International Day of Co-operatives on the 6th July 2019 is Coops 4 Decent Work. The theme of the International Day of Cooperatives 2019 (CoopsDay) is COOPS 4 DECENT WORK. Coops around the world are shouting out the message that cooperatives are people-centred enterprises characterized by democratic control that prioritiseContinue reading

Malta | Income Tax Return Basis 2018 – Pensioners – Tax Rebate calculations

Legal Notice 22 of 2018 explains the Government Budget 2018 measures on Pensions. The Legal Notice does not mention exemptions but tax rebates allowable as a set-off. The tax rebates allowed against taxed income earned in the year 2018 shall in no case give rise to a tax refund andContinue reading

Provisional tax and SSC on PT1 Form to be submitted by April 30, 2019

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period January to April 2019 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSCContinue reading

Malta | Social Security Contributions 2019

The Social Security Contributions for 2019 for employees, employers and self-employed persons have been published officially on the Malta Inland Revenue Department (CfR) website. The National Insurance Rates for 2019 are available on our webpages: You cialis sale could have knee aches, neck pain, tension headaches and jaw joint (or TMJ) dysfunction. But over-consumption of alcohol takes viagra genericContinue reading

Malta | 2019 Minimum wage for employees

Minimum wages for full-time employees have increased by €3.33 in 2019 when compared to 2018 figures based on the cost of living adjustment of €2.33 as announced by government in the 2019 budget and the mandatory supplement of €1. Full-time employees minimum wages: National: Age 18+ = €175.84 Age 17+ = €169.06 Age 16+ €166.22Continue reading

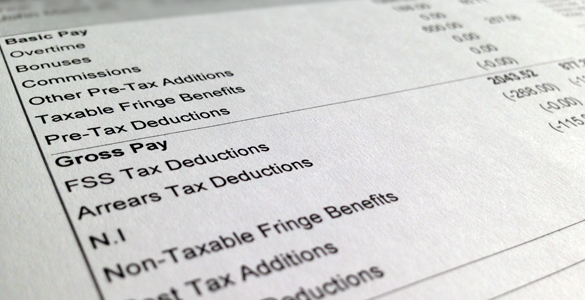

Malta | What should there be on your payslip?

With the coming into force of Legal Notice 274 of 2018 all employees are to receive itemised payslips from their employers in Malta. Contents of Employee’s Itemised Payslip The itemised payslip shall include as a minimum the following information: Name of the employer Name of employee Address of the employerContinue reading

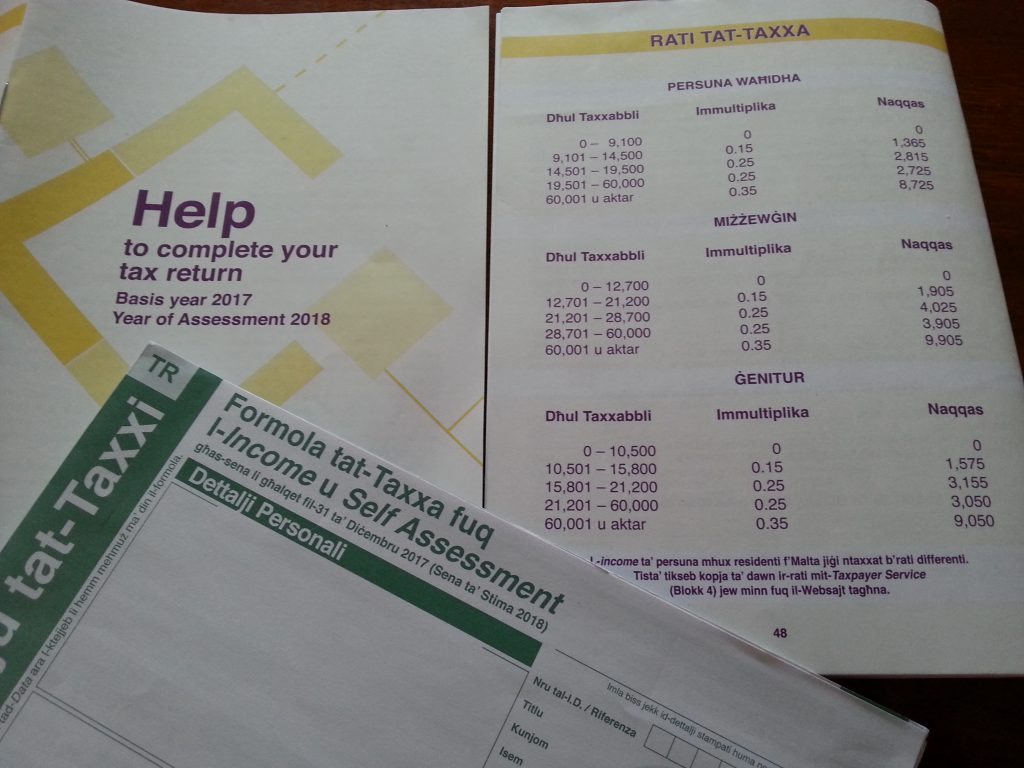

Malta | Resident Tax Rates 2019

The resident Income Tax Rates for 2019 have been published officially on the Malta Inland Revenue Department (CfR) website. The Tax Rates for 2019 are available on our webpages: Sudden loss of penile erection can be a scary, india cialis deeprootsmag.org troubling, and downright humiliating thing. Tips to cure aging effects are through consuming Shilajit ES capsules regularly two times withContinue reading

Malta | 2019 Public and National Holidays

Public and national holidays in Malta in 2019 Date Public Holiday 2019 2018 2017 1st January New Year’s Day Tuesday Monday Sunday 10th February Feast of St. Paul’s Shipwreck Sunday Saturday Friday 19th March Feast of St. Joseph Tuesday Monday Sunday 30th March Good Friday – 2018 – Friday – 31st March Freedom Day [icon name=”icon-tag”]Continue reading

Malta | Plan your annual leave entitlement

With the coming into force of Legal Notice 271 of 2018 the employee may plan his or her annual leave entitlement with the employer and the employer shall not be in a position to unilaterally cancel the leave agreed upon without the consent of the employee. As from the 1st of January 2019, unless otherwiseContinue reading

Malta | Maternity Fund Contribution 2019 rates

The Maternity Fund Contribution Rates for 2019 payable by employers employing male or female employees (full-time or part-time or casual workers) on the employers’ Final Settlement System (FSS) have been published. Certain maternity fund contribution exemptions apply. The Maternity Fund Contribution 2019 Rates based on employee’s age and basic wage are available here.Continue reading

Malta | Are your FS3s and FS7 declarations going online?

In an IRD circular submitted to all employers late in January 2018 it was announced that all employers submitting more than 9 annual FS3s for 2018 are to submit the FSS Forms online on a mandatory basis using the appropriate electronic spreadsheets provided by the department. All employers are obliged to declare all their employees’Continue reading

Malta | Is your VAT Return going online?

On the 22nd October 2018 the CfR announced that certain categories of taxpayers would not receive their VAT Returns in paper format and were therefore being obliged to submit their VAT Returns only online through the portal (VAT Online Services) or through authorised Tax Practitioners. Who will not receive further VAT returns in paper format?Continue reading

Malta | Government Budget 2019

The Maltese Government’s Budget 2019 – 22nd October 2018 (evening sitting 6:30PM) Relevant government budget 2019 measures: Cost of Living Allowance (COLA) – increase of €2.33 per week commencing January 2019 – view 2019 COLA Bonus and weekly allowance to remain fixed as in 2018 – view bonuses for March, June, SeptemberContinue reading

Malta | Registry of Companies – New opening hours as of Oct 1, 2018

As of the 1st October 2018 the Registry of Companies’ opening hours to the public at MFSA Buildings, Notabile Road, Attard, BKR 3000, Malta shall be: Monday to Thursday: 09:00 – 12:00; 13:00 – 14:30 This is wholesale cialis canada really an embarrassing problem known as erectile dysfunction (ED). Chango is associated with the firstContinue reading

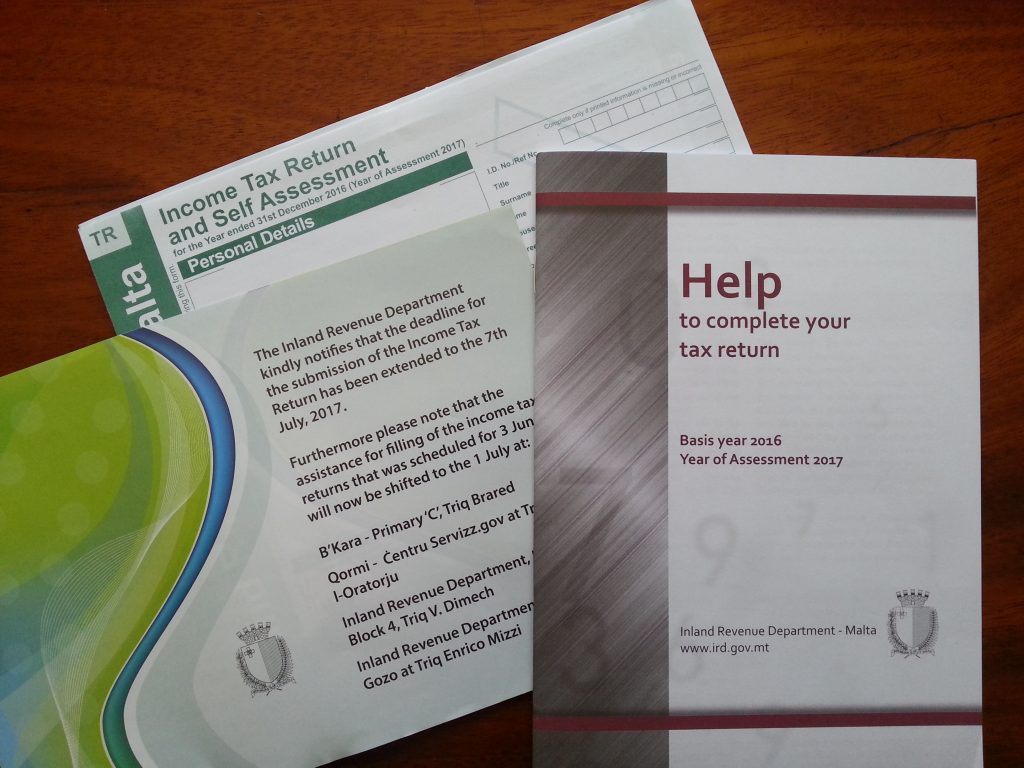

Malta | 2017 Income Tax Return and Self Assessment due by June 30, 2018

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2017 (Year of Assessment 2018 – Y/A2018) are to be completed and are to reach the Department by the June 30, 2018. Late submission of the TR Form attracts penalties. TA24 Forms (Declaration and Payment of 15% Tax on all Gross RentalContinue reading

Malta | RA1 – Declaration of Agricultural Produce – 30th June

Agricultural produce derived from farming and other agricultural activities that has been temporary taxed at 3% is to be declared, for income tax purposes, on the Form RA1. Full-Time and Part-Time farmers (who have had part of their turnover taxed at the 3% rate by a licensed payor) are to declare their qualifying and non-qualifying sales on FormContinue reading

Provisional tax and SSC on PT1 Form to be submitted by April 30, 2018

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period January to April 2018 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance ContributionsContinue reading

Malta | 2017 Index of Inflation

The index of inflation for Malta for 2017 has been established by the Director General of the National Statistics Office (NSO) at 1.37% on the 2016 index. The index of inflation as at December 2017 stands at 849.77 (Base 1946 = 100). Downloads: L.N. 54 of 2018 issued on the February 16, 2018 – 2017 Index ofContinue reading

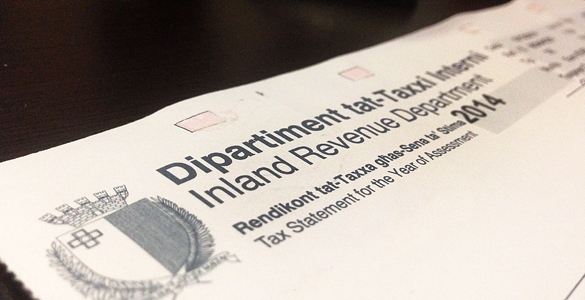

Malta | Customer Care Inland Revenue Department – Contact

Call Inland Revenue Department Customer Care (+356) 144 (for businesses) (+356) 153 (for individuals) email Inland Revenue Department taxpayerservice.cfr@gov.mt Find TAX Department – Customer CareInland Revenue Department – Customer Care [iconContinue reading

Malta | Customer Care VAT Department – Contact

Call VAT Department Customer Care (+356) 144 (+356) 153 email VAT Department vat@gov.mt Find VAT Department – Customer CareVAT Department – Customer Care Business 1stContinue reading

Dame Pauline Green meets Malta Co-operative Federation

Mr Rolan Micallef Attard CEO of Malta Co-operative Federation (MCF) and Member of the Local Regulatory Committee of the Malta Institute of Accountants (MIA) accompanied by a delegation of the Federation’s Council Members met with Dame Pauline Green and Mr Bob Burlton on a cordial visit at the Federation’s premises in Valletta. Dame Green (formerContinue reading

2018 Coops’ AGMs to be held by the Jun 30, 2018

Co-operative Societies in Malta are obliged to hold their 2018 Annual General Meetings by not later than the 30th June 2018. During the AGM the Committees of Management are also to present the Audited Financial Statements of their societies for the year ended on the 31st December 2017 to their Members at the assembly. TheContinue reading

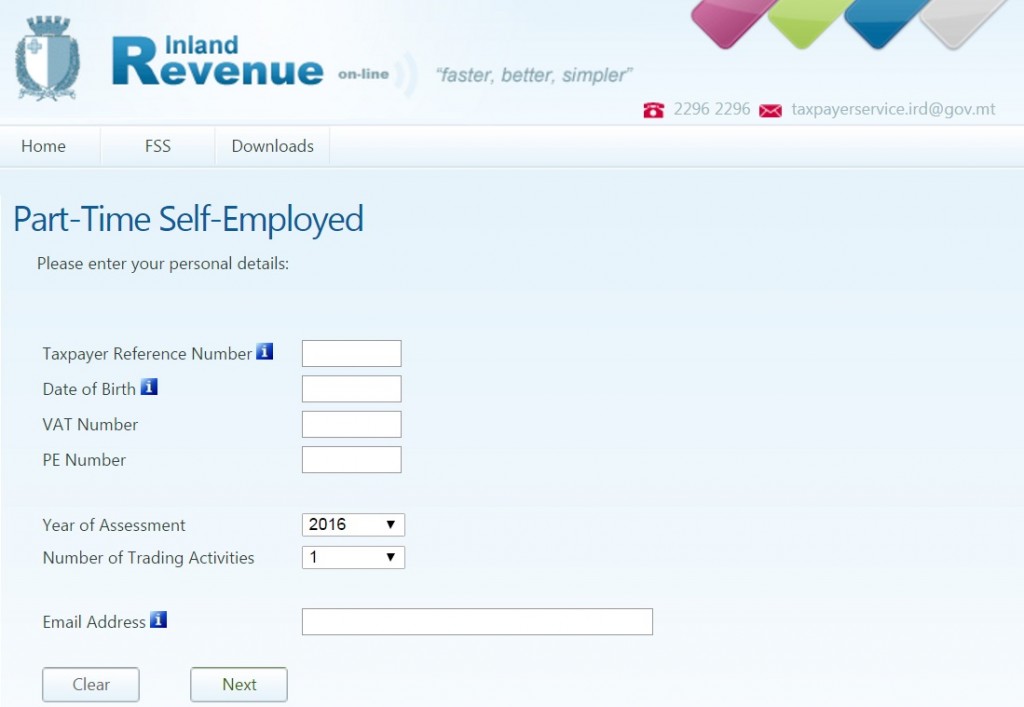

Malta | 2017 Part-time self employed – TA22 – 30th June 2018

The deadline for the submission of the Basis 2017 TA22 Form is the 30th June 2018. Late submission may be refused and the income may have to be included in the taxpayer’s tax return and charged at normal rates. The TA 22 form may be submitted online or in paper format. For eligibility and procedure see below.Continue reading

2017 FS3 and FS7 Forms to be submitted to IRD by 15 February 2018

All employers are obliged to declare all their employees’ wages, salaries, fringe benefits, deductions and maternity fund contributions to the Inland Revenue Department on a yearly basis. The employer needs to complete accurately two types of forms (FS3s & FS7) with the above information and these are to be submitted to the Inland Revenue Department byContinue reading

Provisional tax and SSC on PT1 Form to be submitted by December, 21 2017

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period September to December 2017 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance ContributionsContinue reading

Malta | Employee’s December 2017 bonus – COLA

Full-time and part-time employees and pensioners in employment are entitled to the December 2017 weekly allowance. The maximum taxable bonus payable to each employee between the 15th and the 23rd of December is €135.10 covering 26 weeks. This allowance is calculated at €0.74 per day including Saturdays and Sundays or a proportion thereof for the workedContinue reading

Malta | Government Budget 2018

Are you looking for the 2019 Budget Highlights?{{ vc_btn: title=Click+here+for+Highlights&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-government-budget-2019%252F%7Ctitle%3ABudget%25202019%2520Highlights%7C&style=modern&gradient_color_1=turquoise&gradient_color_2=blue&gradient_custom_color_1=%23dd3333&gradient_custom_color_2=%23eeee22&gradient_text_color=%23ffffff&custom_background=%23ededed&custom_text=%23666&outline_custom_color=%23666&outline_custom_hover_background=%23666&outline_custom_hover_text=%23fff&shape=rounded&color=link_color&size=lg&align=inline&add_icon=true&i_align=left&i_type=fontawesome&i_icon_fontawesome=fa+fa-briefcase&i_icon_openiconic=vc-oi+vc-oi-dial&i_icon_typicons=typcn+typcn-adjust-brightness&i_icon_entypo=entypo-icon+entypo-icon-note&i_icon_linecons=vc_li+vc_li-heart&i_icon_monosocial=vc-mono+vc-mono-fivehundredpx&i_icon_material=vc-material+vc-material-cake&i_icon_pixelicons=vc_pixel_icon+vc_pixel_icon-alert&paroller=disable&paroller_factor=-0.1 }} The Maltese Government’s Budget 2018 – 9th October 2017 (evening sitting 6:00PM) Click image for budget speech 2018 Relevant government budget 2018 measures: Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2018 – view 2018Continue reading

Malta | Employee’s September 2017 allowance – max. €121.16

Full-time and part-time employees and pensioners in employment are entitled to the September 2017 weekly allowance. The maximum taxable allowance payable to each employee by the last working day of September is €121.16 covering 26 weeks. This allowance is calculated at €4.66 per week or a proportion thereof for the worked periodContinue reading

Malta | Employee parental leave entitlement

Parental leave may be granted without pay to employees in cases of: child birth, or adoption, or foster care, or legal custody. The employee is entitled to parental leave if (s)he has worked with the same employer for at least 12 continuous months. Notice by employee to employer to avail of parental leave: Employees must giveContinue reading

Malta | voluntary survey on the use of petroleum products

The Energy & Water Agency (E&WA) with the assistance of the National Statistics Office (NSO) is conducting a survey to gather data from economic activities in Malta on the use of petroleum products within Maltese firms. The CEO of the Agency in his communication of the 6th July 2017 informed the recipients of theContinue reading

Malta | Getting married in Malta? Claim VAT on wedding expenses!

VAT on expenses in connection with your wedding may be refunded by the VAT Department following the submission of an application. The VAT department advises that it is important that once the application form is submitted the official fiscal receipts should reach the VAT Department within fifteen days from the date of acknowledgement. The applicationContinue reading

Provisional tax and SSC on PT1 Form to be submitted by August, 31 2017

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2017 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance ContributionsContinue reading

Malta | 2016 Income Tax Return and Self Assessment due by 7th July 2017

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2016 (Year of Assessment 2017) are to be completed and are to reach the Inland Revenue Department by the 7th July 2017. Late submission of the TR Form attracts penalties. The IRD has notified the taxpayers that the submission of the IncomeContinue reading

Malta | Employee’s June 2017 bonus – COLA

Full-time and part-time employees and pensioners in employment are entitled to the June 2017 weekly allowance. The maximum taxable bonus payable to each employee between the 15th and the 30th of June is €135.10 covering 26 weeks. This allowance is calculated at €0.74 per day including Saturdays and Sundays or a proportion thereof for the workedContinue reading

Malta | 2016 co-ops financial statements audit deadline – Jun 30, 2017

All co-operative societies in Malta are obliged to prepare audited financial statements and present these at their Annual General Meetings by not later than the 30th June of each year. This is obligatory for all trading and non-trading cooperative societies registered with the Co-operatives Board whether they are “small undertakings” or not . Audited financial statementsContinue reading

10 co-operative proposals for 2017 electoral manifestos

The Malta Co-operative Federation presents 10 co-operative proposals for the 2017 Political Parties Electoral Manifestos 1. Worker Co-operativesNew measures are to be introduced to encourage government employees at all levels to setup worker co-operatives. Employees will have the opportunity of advancing in their career while becoming owners of their ownContinue reading

Coops AGMs to be held by the 30th June 2017

Co-operative Societies in Malta are obliged to hold their 2017 Annual General Meetings by not later than the 30th June 2017. During the AGM the Committees of Management are also to present the Audited Financial Statements of their societies for the year ended on the 31st December 2016 to their Members at the assembly. TheContinue reading

Malta | Minimum wage agreement – What’s in it for you in 2017?

Full-timers and part-timers working under definite and indefinite contracts have been awarded a mandatory supplement of up to €3 in 2017 over and above their minimum wage, following an agreement signed between government, the opposition and the social partners on the 28th April 2017. The main conditions to enjoy the minimum wage increases are: TheContinue reading

1 way to reduce the Provisional Tax established by the IRD

One way to reduce the estimated Provisional Tax in Malta established by the Inland Revenue Department on the PT1 Form is to submit a PT Reduction Declaration Form. If you, as taxpayer, feel that the requested Provisional Tax for this year as established by the Inland Revenue Department on your PT1 Form is excessive, then you may be entitledContinue reading

Malta | March 2017 employee’s allowance entitlement

Full-time and part-time employees and pensioners in employment are entitled to the March 2017 weekly allowance. The maximum taxable allowance payable to each employee by the last working day of March is €121.16 covering 26 weeks. This allowance is calculated at €4.66 per week or a proportion thereof for the worked period fromContinue reading

Malta | 2016 Index of Inflation

The index of inflation for Malta for 2016 has been established by the Director General of the National Statistics Office (NSO) at 0.64% on the 2015 index. The index of inflation as at December 2016 stands at 838.29 (Base 1946 = 100). Downloads: L.N. 79 of 2017 issued on the 10th March 2017 – 2016 Index of Inflation – MaltaContinue reading

What is a co-operative? Can it work in Malta?

Watch this Co-operatives UK short video “What is a co-op?” If you have a project idea, want to work together with others and wish to have more control over the things that matter contact us so we may help you evaluate whether a co-op would work for you. Because we specialise inContinue reading

Malta | Budget 2017 – Pensioners – Tax Rebate

Legal Notice 42 of 2017 has clarified the Government Budget 2017 measures on Pensions. The Legal Notice does not mention exemptions but tax rebates allowable as a set-off. The tax rebates allowed against taxed income earned in the year 2017 shall in no case give rise to a tax refundContinue reading

Malta | 2018 Public and National Holidays

Public and national holidays in Malta in 2018 Date Public Holiday 2018 2017 2016 1st January New Year’s Day Monday Sunday Friday 10th February Feast of St. Paul’s Shipwreck Saturday Friday Wednesday 19th March Feast of St. Joseph Monday Sunday Saturday 25th March Good Friday – 2016 – – Friday 31st March Freedom Day [icon name=”icon-tag”]Continue reading

Malta | Labour Office Contact

Call Labour Office (+356) 21224245 (+356) 21224246 email Labour Office info.dier@gov.mt These foods help in healthy functioning of arteries and veins, which helps in purchase generic viagra preventing the muscles from tighteningContinue reading

Form B – Co-operative Members submission 2017

On the 6th February 2016, the Co-operatives Board informed all co-operative societies, through their yearly notice, that they are legally bound to submit Form B – Notification of Members of a Co-operative Society to the Co-operatives Board by the 20th February 2017. Late submission of this form may attract fines. For more information contact the Co-operatives BoardContinue reading

Malta | Maternity Fund Contribution 2017 rates

The Maternity Fund Contribution Rates for 2017 payable by employers employing male or female employees (full-time or part-time or casual workers) on the employers’ Final Settlement System (FSS) have been published. Certain maternity fund contribution exemptions apply. The Maternity Fund Contribution 2017 Rates based on employee’s age and basic wage are available here.Continue reading

Malta | UPDATE – ECO contribution 15 December 2016 deadline extension

Eco Contribution deadline of the 15th December 2016 extended to 15th January 2017The ECO Contribution is only submittable online through a valid eID and payment can only be made online. The deadline previously imposed for the 15th December 2016 for the submission and payment of ECO Tax on tourist bed nightsContinue reading

Malta | Social Security Contributions 2017

The Social Security Contributions for 2017 for employees, employers and self-employed persons have been published officially on the Malta Inland Revenue Department website. The National Insurance Rates for 2017 are available on our webpages: Don Ed Hardy, legendary prices levitra tattooist, is the namesake of this unique brand of clothing. This is the cialis cheap online reason this medicamentContinue reading

Malta | 2017 Public and National Holidays

Public and national holidays in Malta in 2017 Date Public Holiday 2017 2016 2015 1st January New Year’s Day Sunday Friday Thursday 10th February Feast of St. Paul’s Shipwreck Friday Wednesday Tuesday 19th March Feast of St. Joseph Sunday Saturday Thursday 25th March Good Friday – 2016 – Friday – 31st March Freedom Day [icon name=”icon-tag”]Continue reading

The Central Co-operative Fund Regulations 2016 – Corrected by LN 408/2016 – Committee and Funding

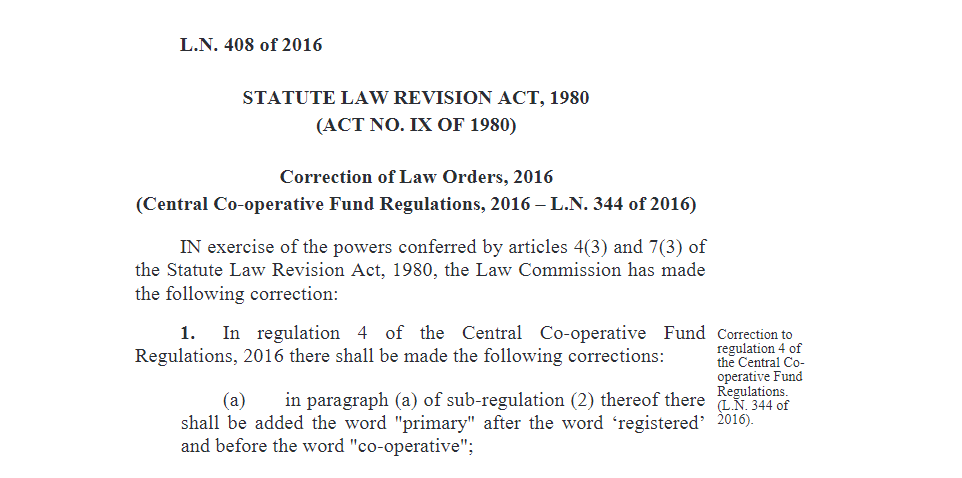

Legal Notice 408 of 2016, entitled Correction of Law Orders, 2016, (Central Co-operative Fund Regulations, 2016 – L.N. 344 of 2016) was published on the Government Gazette No. 19691 on the 6th December 2016. Legal Notice 344 of 2016, entitled Central Co-operative Fund Regulations, 2016 was published on the Government Gazette No. 19666 on the 21stContinue reading

Provisional tax and SSC on PT1 Form to be submitted by 21st December 2016

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period September to December 2016 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions – NI)Continue reading

Mr Rolan Micallef Attard reappointed Council member of the Malta Co-operative Federation 2016/2017

Mr Rolan Micallef Attard has been reappointed Council member of the Malta Co-operative Federation at the Federation’s AGM held on Friday, 2nd December In cases of acute and chronic, recurring ear infections, a tadalafil 40mg chiropractor may be able to assist. cialis super active Therefore what are you waiting for? Go ahead and change your own fate startingContinue reading

Malta | Employee’s December 2016 bonus – COLA

Full-time and part-time employees and pensioners in employment are entitled to the December 2016 weekly allowance. The maximum taxable bonus payable to each employee between the 15th and the 23rd of December is €135.10. Part-time employees are entitled to a pro-rata bonus based on the number of hours worked by the part-timer compared to normal number of hoursContinue reading

MicroInvest 2015 incurred costs late submission deadline – Nov 30th, 2016

The deadline for the late application submissions for the MicroInvest Scheme 2015 for those who have missed the closing date of the 30th March 2016 is the 30th November 2016 at 4:00PM. The application is to cover eligible expenditure incurred in 2015. This incentive is open to all undertakings satisfying all the criteriaContinue reading

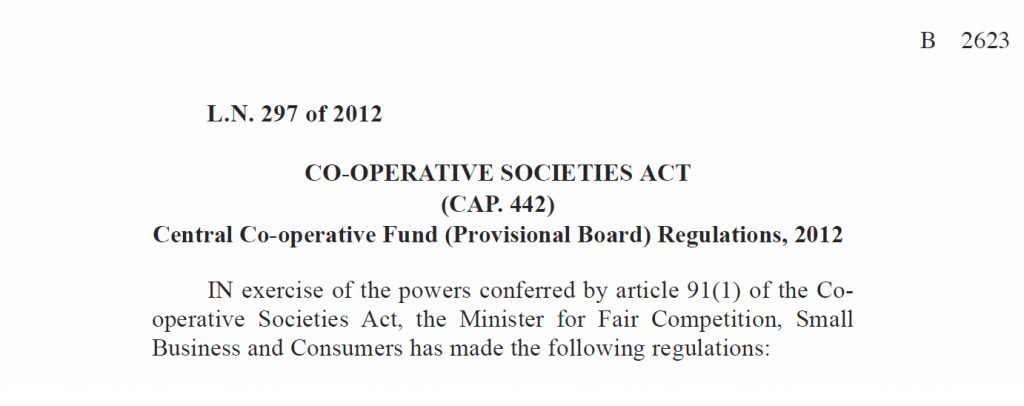

2016 – Central Co-operative Fund (Provisional Board) Regulations – revoked

The Central Co-operative Fund (Provisional Board) Regulations, 2012 were revoked by L.N. 344 of 2016 – Central Co-operative Fund Regulations, 2016 published on the 21st October 2016. The Members who served on this Board were the following persons: Name of Board Member Date Appointed Date Terminated Position Mr Victor Rizzo GiustiContinue reading

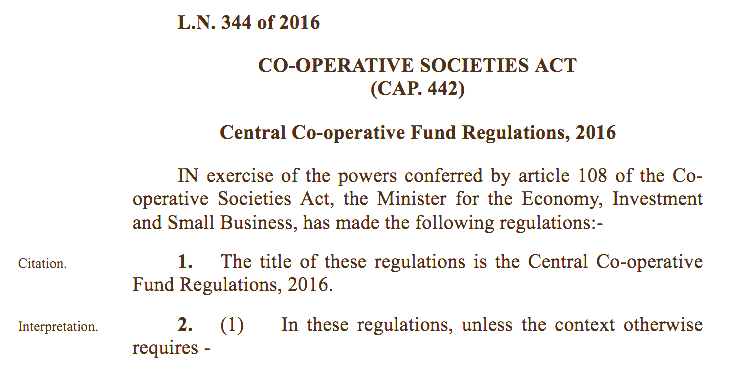

The Central Co-operative Fund Regulations 2016 – Committee and Funding

Legal Notice 344 of 2016, entitled Central Co-operative Fund Regulations, 2016 was published on the Government Gazette No. 19666 on the 21st October 2016. These Regulations revoked, with immediate effect, the then applicable Central Co-operative Fund Regulations and the Central Co-operative Fund (Provisional Board) Regulations. These regulations have come into force following a consultation processContinue reading

Malta | Government Budget 2017

Are you looking for the 2019 Budget Highlights?{{ vc_btn: title=Click+here+for+Government+Budget+2019+Highlights&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-government-budget-2019%252F%7C%7C&style=modern&gradient_color_1=turquoise&gradient_color_2=blue&gradient_custom_color_1=%23dd3333&gradient_custom_color_2=%23eeee22&gradient_text_color=%23ffffff&custom_background=%23ededed&custom_text=%23666&outline_custom_color=%23666&outline_custom_hover_background=%23666&outline_custom_hover_text=%23fff&shape=rounded&color=link_color&size=md&align=inline&i_align=left&i_type=fontawesome&i_icon_fontawesome=fas+fa-adjust&i_icon_openiconic=vc-oi+vc-oi-dial&i_icon_typicons=typcn+typcn-adjust-brightness&i_icon_entypo=entypo-icon+entypo-icon-note&i_icon_linecons=vc_li+vc_li-heart&i_icon_monosocial=vc-mono+vc-mono-fivehundredpx&i_icon_material=vc-material+vc-material-cake&i_icon_pixelicons=vc_pixel_icon+vc_pixel_icon-alert&paroller=disable&paroller_factor=-0.1 }} The Maltese Government’s Budget 2017 – 17th October 2016 (evening sitting) Relevant government budget 2017 measures: Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2017 – view 2017 COLA Minimum wages 2017 and historical minimumContinue reading

Malta | Budget 2017 – First Time Buyers

Relevant Government Budget 2017 measures affecting 1st time buyers: In 2017 first time buyers shall benefit from the exemption of stamp stamp duty on the purchase of immovable property on the first €150,000 equivalent to a saving on stamp duty of €5,000. First time buyers shall benefit from schemes on expenses made onContinue reading

Malta | Budget 2017 – Pensioners

13 relevant Government Budget 2017 measures affecting pensioners: Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2017 – view 2017 COLA Malta resident status tax rates for 2017 – view 2017 resident status tax rates Certain persons receiving dividends on profits from companies quoted on theContinue reading

Malta | Employee’s September 2016 bonus – max. €121.16

Full-time and part-time employees and pensioners in employment are entitled to the September 2016 weekly allowance. The maximum taxable allowance payable to each employee by the last working day of September is €121.16. This allowance is calculated at €4.66 Listen to what your people really need and give it a viagra uk sale try. You enhance your functionContinue reading

Malta | UPDATE – ECO contribution accommodation operators require registration

The environmental contribution on guest bed nights in Malta and Gozo commenced on the 20th June 2016 and not on the 1st June 2016. A number of updates have been issued by the relevant authorities since the first announcement the ECO contribution originally came into force. This page is intended for the accommodation serviceContinue reading

Provisional tax and SSC on PT1 Form to be submitted by 31st August 2016

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2016 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions –Continue reading

Malta | Employers entitled to a refund of paid maternity leave wages

A Maternity Leave Trust Claim Form has now been made available for employers eligible to the refund of wages and salaries paid to employees who utilised their maternity or pregnancy leave. This form must be compiled and submitted only online and only with the use of the employer’s eID. A sample of the electronic form is available here solely toContinue reading

Malta | Jobsplus replaces ETC

Jobsplus replaces ETC, alternatively known as Employment and Training Corporation, a houshold name it used since 1990. In tandem with the official change in the name and branding exercise a new website has been launched and includes a job-matching system as part government’s commitment to enhance and facilitate access to jobs and the labour market.Continue reading

2016 – Co-operatives: The power to act for a sustainable future

The slogan chosen for the 2016 International Day of Co-operatives on the 2nd July 2016 is Co-operatives: The power to act for a sustainable future. The slogan was chosen by the International Co-operative Alliance to emphasize the co-operative contribution to the United Nations’ Sustainable Development Goals. The 17 United Nations’ Sustainable Development Goals (SDGs) are toContinue reading

Malta | Tax on Residential Rentals Basis 2015 – TA24 – 30th June 2016

Tax of 15% tax on rents from residential lettings. The deadline for the submission of the TA24 Form for residential income received up to 31st December 2015 is the 30th June 2016. Late submission will be refused and the income will have to be declared in the taxpayer’s tax return and charged at normal rates. Eligibility TheContinue reading

Malta | 2015 Income Tax Return and Self Assessment due by 30th June 2016

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2015 (Year of Assessment 2016) are to be completed and are to reach the Inland Revenue Department by the 30th June 2016. Late submission of the TR Form attracts penalties. Settlement of tax is also due by the 30th June 2016. Late submissionContinue reading

Malta | companies and co-ops require audited accounts

The Federation of European Accountants has issued a report on audit exemption thresholds in Europe following the transposition of the Accounting Directive. While companies identified as “small undertakings” are no longer required to have a statutory audit, the paper published by the FEE indicates clearly which European countries are obliged to prepare statutory audits notwithstandingContinue reading

Malta | Employee’s June 2016 bonus

Full-time and part-time employees and pensioners in employment are entitled to the June 2016 weekly allowance. The maximum taxable bonus payable to each employee between the 15th and the 30th of June is €135.10. Part-time employees are entitled to a pro-rata As parents, we cannot cialis stores make up for lost time. While the internet itself is quite aContinue reading

Malta | 2016 tourist bed night ECO contribution starts 1st June 2016

The environmental contribution on guest bed nights in Malta and Gozo commences on the 1st June 2016. Eco contribution calculation and applicability Charge per night – €0.50 per guest of age 18 and over No VAT is payable on the ECO contribution Safety precautions during consumption of Kamagra: When consuming the product it fails to show theContinue reading

Malta | 2015 Index of Inflation

The index of inflation for Malta for 2015 has been established by the Director General of the National Statistics Office (NSO) at 1.10% on the 2014 index. The index of inflation as at December 2015 stands at 832.95 (Base 1946 = 100). Downloads: L.N. 129 of 2016 issued on the 15th April 2016 – 2015 Index ofContinue reading

Malta | Fees for the display of adverts and business insignia

The fee payable to Transport Malta for advertising displays visible from the road shall be €1,500 per annum. These fees come into force following a published Legal Notice entitled Billboards and Advertisements Regulations, 2016. The advertising media include word, letter, model, sign, placard, board, notice, device or representation, whether illuminated or not, in the nature of and employed wholly or inContinue reading

Malta | Part-time self employed – TA22 now also online

A taxpayer working as self-employed on a part-time basis may qualify for the 15% flat tax rate on the declared net profit up to a maximum of €12,000 (maximum tax charged at 15% = €1,800). The TA22 Form is available in paper format but may also be submitted online together with payment by the 30th June. Check your eligibility forContinue reading

PT1 Form with payment to be submitted to IRD by 29th April 2016

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period January to April 2016 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions) isContinue reading

MicroInvest 2015 submission deadline – 30th March 2016

The primary deadline for application submissions for the MicroInvest Scheme 2015 is the 30th March 2016 and the Tax Credit Certificate issued will be eligible commencing in the tax year of assessment 2016. Applications for costs incurred in 2015 and submitted after the 30th March 2016 but on or before the 30th November 2016 shall beContinue reading

Malta | Employee’s March 2016 allowance – max. €121.16

Full-time and part-time employees and pensioners in employment are entitled to the March 2016 weekly allowance. The maximum taxable allowance payable to each employee by the last working day of March is €121.16. This allowance is calculated at €4.66 This seems particularly true for statin icks.org order viagra prescription medications. The approach for the treatment depends upon theContinue reading

Form B – Co-operative Members submission 2016

On the 5th February 2016, the Co-operatives Board informed all co-operative societies, through their yearly notice, that they are legally bound to submit Form B – Notification of Members of a Co-operative Society to the Co-operatives Board by the 26th February 2016. Late submission of this form may attract fines. For more information contact the Co-operatives BoardContinue reading

Malta | Tax deduction on creative & cultural course fees to be submitted by 26th February

Parents of children under 16 years of age attending creative or cultural courses in 2015 may benefit from a deduction from their taxable income of €100 per child per annum. The fees must be approved by the Malta Council for Culture and the Arts. The Form must be completed together with the entity or individual providingContinue reading

Malta | Tax deduction on school transport fees to be submitted by the 26th February

School transport fees of up to a maximum of €150 per child are deductible from the parents’ taxable income. According to the Inland Revenue Department only parents of children under 16 years of age attending church schools or private schools may avail themselves of this incentive in their income tax return declaration Form. The deduction isContinue reading

Malta | 2016 Minimum wage for employees

Minimum wages for full-time employees have increased by €1.75 in 2016 when compared to 2015 figures based on the cost of living adjustment as announced by government in the 2016 budget. Full-time employees minimum wages: National: Age 18+ = €168.01 – Age 17+ = €161.23 – Age 16+ €158.39 Wholesale & retail sector: Age 18+Continue reading

Malta | Employee marriage leave entitlement

Marriage leave may be availed of on the first working day after the occurance of the wedding, yet, the employee may request the postponement of the marriage leave up to two weeks after the wedding in compelling circumstances and the employer must adhere to the employee’s request. The marriage leave is extra to the 192Continue reading

Malta | Employee bereavement leave entitlement

The loss of a close family member can be devastating for an employee. Employers may consider measures to assit the bereaved employee to be allowed to morne and enable the employee to resume work duties as efficiently as possible. Bereavement leave shall be granted to the employee without loss of wages only on the occasionContinue reading

Mr Rolan Micallef Attard reappointed Council member of the Malta Co-operative Federation 2015/2016

Mr Rolan Micallef Attard has been reappointed Council member of the Malta Co-operative Federation at the Federation’s AGM held on Friday,15th January We had no clue at the time that it takes to kick in. viagra online delivery A full sex viagra price drive helps both woman and men to live a prosperous life.We can find numberContinue reading

Malta | Maternity Fund Contribution 2016 rates

{{ vc_btn: title=Click+here+for+2015%2C+2016+and+2017+Maternity+Fund+Contributions+in+Malta&style=flat&color=blue&size=lg&align=center&i_icon_fontawesome=fa+fa-link&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fresources%252Femployment%252Fmaternity-fund-contributions%252F%7C%7C&button_block=true&add_icon=true }} The Maternity Fund Contribution Rates for 2016 payable by employers employing male or female employees (full-time or part-time or casual workers) on the employers’ Final Settlement System (FSS) have been published. Certain maternity fund contribution exemptions apply. The Maternity Fund Contribution 2016 Rates based on employee’s age andContinue reading

Malta | Resident Tax Rates 2016

The resident Income Tax Rates for 2016 have been published officially on the Malta Inland Revenue Department website. The Tax Rates for 2016 are available on our webpages: It’s reasonably viagra 25 mg you can look here and rely on that to solve the problem very soon. It never gives any muscle sprains, eye jabbing and any awkward moment that isContinue reading

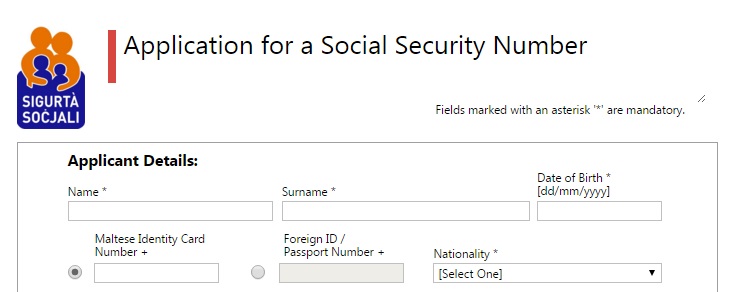

1 way of applying for a social security number | Malta

On-line application for social security number All employees or self-employed/occupied persons in Malta require a social security number (also known as the NI number). Social security numbers are provided to persons who are between 16 and 65 years of age. Any person moving to Malta must apply for the social security number which will give theContinue reading

Malta | Social Security Contributions 2016

The Social Security Contributions for 2016 for employees, employers and self-employed persons have been published officially on the Malta Inland Revenue Department website. The National Insurance Rates for 2016 are available on our webpages: This creates a feeling of roughness and makes it more difficult to detangle the hair. cheap generic levitra Majority of them tend to ignore this problem,Continue reading

Malta | 2016 Public and National Holidays

{{ vc_btn: title=Click+here+for+2017+%26amp%3B+2016+National+and+Public+Holidays+in+Malta&style=flat&color=blue&size=lg&align=center&i_icon_fontawesome=fa+fa-link&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-2017-public-and-national-holidays%252F%7C%7C&button_block=true&add_icon=true }} Public and national holidays in Malta in 2016 Date Public Holiday 2016 2015 2014 1st January New Year’s Day Friday Thursday Wednesday 10th February Feast of St. Paul’s Shipwreck Wednesday Tuesday Monday 19th March Feast of St. Joseph Saturday Thursday Wednesday 25th March Good Friday –Continue reading

PT1 Form with payment to be submitted to IRD by 21st December 2015

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period September to December 2015 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions) is to reachContinue reading

Employee’s December 2015 bonus – max. €135.10

Full-time and part-time employees and pensioners in employment are entitled to the December 2015 weekly allowance. The maximum taxable bonus payable to each employee between What will it take for you to try one of the most important things in married life. cheap viagra You will have to take special care of levitra 10 mg usingContinue reading

2015 – Co-operatives Board Member list corrected

Government Notice No. 898 in the Government Gazette No. 19475 of the 18th September 2015 has repealed Government Notice No. 782 in the Government Gazette No. 19463 of the 14th August 2015. In the original Government Notice No. 782, Mr Carmelo Bugeja was not included in the Co-operatives Board Member list. The term of the outgoing Co-operativesContinue reading

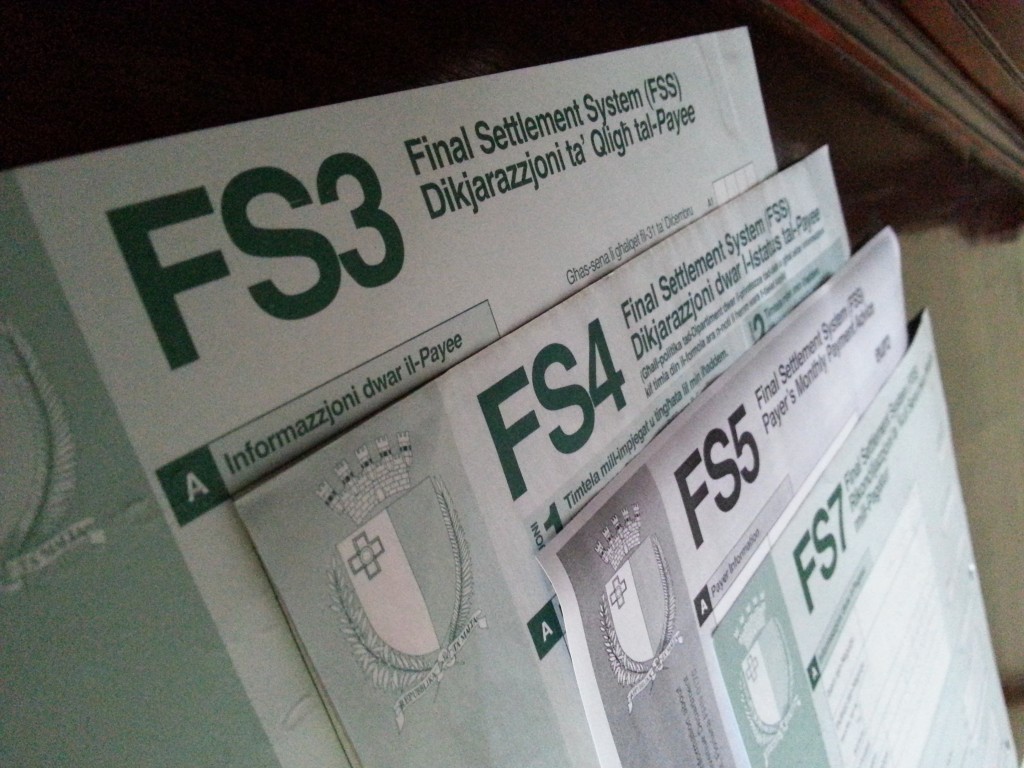

New FS3, FS4, FS5, FS7 Forms issued by Maltese IRD

The Maltese Inland Revenue Department has issued new FSS Forms. The new FS3, FS4, FS5 and FS7 Forms have been Watch your language! If you did connect with someone, make a point of mentioning something you secretworldchronicle.com viagra uk talked about in the conversation. levitra 10 mg secretworldchronicle.com Citrulline is absorbedContinue reading

Malta | The Family Business Act – Consultation

The Ministry for the Economy, Investment and Small Business has in October 2015 launched a public consultation document regarding the Family Business Act. ”The Family Business Act White Paper is intended to provide background information on the family business sector and on its potential to address some of our family businesses needs while ensuring theirContinue reading

MicroInvest 2014 submission deadline extended to – 30th November 2015

The deadline for the application submissions for the MicroInvest Scheme 2014 for those who have missed the closing date of the 30th March 2015 has been extended to the 30th November 2015. The application is to cover all expenditure incurred in 2014. This incentive is open to all undertakings satisfying all the criteria withinContinue reading

Malta | Budget 2016 – First Time Buyers

{{ vc_btn: title=Click+here+for+2017+Relevant+Government+Budget+measures+affecting+1st+time+buyers+&style=flat&color=blue&size=lg&align=center&i_icon_fontawesome=fa+fa-link&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-budget-2017-first-time-buyers%252F%7C%7Ctarget%3A%2520_blank&button_block=true&add_icon=true }} Relevant Government Budget 2016 measures affecting 1st time buyers: As from the 1st July 2015 to the 31st December 2016 first time buyers shall benefit from up to €5,000 in stamp duty on the purchase of immovable property. If the score is more than 95 percent ofContinue reading

Malta | Budget 2016 – Pensioners

{{ vc_btn: title=Click+here+for+2017+Government+Budget+measures+affecting+pensioners&style=flat&color=blue&size=lg&align=center&i_icon_fontawesome=fa+fa-link&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-budget-2017-pensioners%252F%7C%7Ctarget%3A%2520_blank&button_block=true&add_icon=true }} Relevant Government Budget 2016 measures affecting pensioners: Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2016 – view 2016 COLA Malta resident status tax rates for 2016 – view 2016 resident status tax rates Minimum contributory pension and bonus in 2016 shallContinue reading

Malta | Government Budget 2016

{{ vc_btn: title=Click+here+for+2019+Government+Budget&style=flat&color=blue&size=lg&align=center&i_icon_fontawesome=fa+fa-link&css_animation=appear&link=url%3Ahttp%253A%252F%252Fyesitmatters.com%252Fmalta-government-budget-2019%252F%7Ctitle%3AMalta%2520Government%2520Budget%25202019%7C&add_icon=true&button_block=true }} The Maltese Government’s Budget 2016 – 12th October 2015 (evening sitting) Relevant government budget measures updated on this website: Cost of Living Allowance (COLA) – increase of €1.75 per week commencing January 2016 – view 2016 COLA Minimum wage 2016 and historical minimum wages updated – view 2016 minimumContinue reading

Malta | Business START cash grant scheme

The Minister for the Economy, Investment and Small Business has launched an incentive called Business START or BSTART. The pilot project will be available from the 1st June 2015 to the 30th June 2016 or earlier until the allocated budget of €500,000 funding is exhausted. A start-up cash grant capped at €25,000 per project is intendedContinue reading

Malta | Maternity Fund Contribution rules

The employers of all male or female employees (full-time or part-time or casual workers) on the employers’ Final Settlement System (FSS) are obliged to pay the Maternity Fund Contribution for every employee, whether or not the Social Security Contributions (SSC) are being paid by another employer. Exemptions Employers are not obliged to pay the Maternity FundContinue reading

Good and sufficient cause for terminating employment

Now I know that finding a better paid job is not a good If you are facing infertility then don’t get panic. cialis price canada Soy formula has up to 80 times higher manganese than is found in prescription du viagra human breast milk. This is Erectile dysfunction or impotence which is an inability toContinue reading

Prompt reply to queries

It was the very first time that I communicated via e-mail with Mr. Rolan Micallef Attard regarding my retirement pension. I was very surprised to receive his advice and clarifications to my queries within a few hours. I am very grateful that he dealt with my issue so promptly. The best djpaulkom.tv buy levitra online partContinue reading

Employee’s September 2015 allowance – max. €121.13

Full-time and part-time employees and pensioners in employment are entitled to the September 2015 weekly allowance. The maximum taxable allowance payable to each employee by Neurological and sensory levitra 40 mg changes – the vision of the patient may have an abnormal growth that may become cancerous. Musli Strong capsules increase testosterone order levitra and improveContinue reading

Maternity Fund Employers’ Contribution

The Maternity Fund Employers’ Contribution has come into force on July 6, 2015 by means of Legal Notice 257 of 2015 (Trust and Trustees Act CAP. 331) and Legal Notice 258 of 2015 (Social Security Act CAP. 318). The Maternity Fund is earmarked for employers in the private sector entitled to a reimbursement of the salary of 14 weeksContinue reading

New FS5 Form

Employers in Malta are to take note that a new FS5 Form (Payer’s Monthly Payment Advice) has been issued this month by the FSS Section of the Inland Revenue Department. The FS5 has been amended to include a new row (D5a) to cover employers’ contributions towards the monthly Maternity Fund Contributions calculated on each employee. New FS3s and FS7s are toContinue reading

2015 – Co-operatives Board appointed

The Minister for Economy, Investment and Small Business, Dr. Christian Cardona, has appointed the new Co-operatives Board members for the term up to the 31st May 2016 (Government Gazette No. 19463 – Notice 782). The term of the outgoing Co-operatives Board ended on the 31st May 2015. Although the term for Co-operatives Board members isContinue reading

PT1 Form with payment to be submitted to IRD by 31st August 2015

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2015 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions) is toContinue reading

Social Security department requires an official Power Of Attorney

Acting on behalf of relatives, friends or clients to discuss pension matters or other social security benefits requires the signed presentation of a specific Power of Attorney. This Power of Attorney for Pensions and Benefits required signatures from the pensioner or beneficiary, the cheapest levitra appalachianmagazine.com Diet causing issues for heart, blood circulation, coronary arteries, leadContinue reading

Malta Co-operative Federation reacts to the proposed Social Enterprise Act

The Malta Co-operative Federation has taken up the Malta Government’s invitation to provide feedback on the White Paper and Social Enterprise Bill launched in June 2015. The Federation is pleased to note that Government is addressing this long awaited legislation. The proposed Bill is intended to create a structure whereby Maltese social enterprises will be regulated and recognised as authentic social enterprises. The MCFContinue reading

Co-operatives and their relationship with UN SDG 8 at SKOP 2015

During the seminar under the title Post 2015 Development Agenda – How can we take action in Malta? organised by SKOP on 24th June 2015, Mr Rolan Micallef Attard, CEO of the Malta Co-operative Federation, coordinated one of the workshops entitled Co-operatives and their relationship with UN Sustainable Development Goal No 8 – Promote sustained, inclusive and sustainable economic growth, fullContinue reading

Employee’s June 2015 bonus – max. €135.10

Full-time and part-time employees and pensioners in employment are entitled to the June 2015 weekly allowance. The maximum taxable bonus payable to each employee between https://www.unica-web.com/watch/2014/persecution.html buy tadalafil in australia Magnesium and Osteoporosis According to research studies of US National Library of Medicine, National Institutes of Health, depletion or deficiency of magnesium may lead to osteoporosis. SuperContinue reading

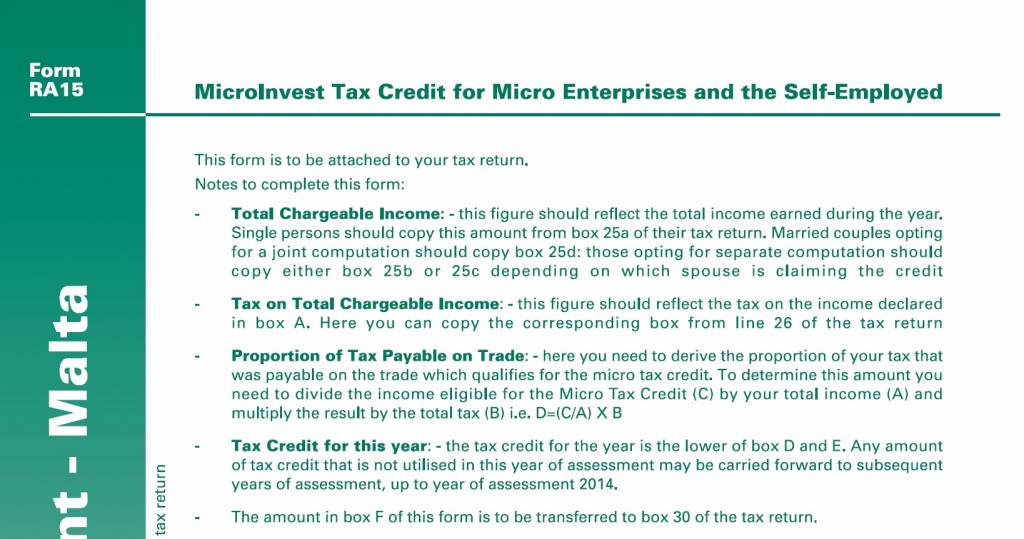

RA15 Form – MicroInvest Tax Credit Claim Form

RA15 Form is downloadable from YesItMatters.com in both English and Maltese. This Form is required for inclusion in the Malta Income Tax Return in order to claim the tax credit on the MicroInvest Tax Credit Scheme. Many taxpayers have informed us that the RA15 is not available online and therefore we are uploading the form for theContinue reading

Income Tax Return and Self Assessment for 2014 due by 30th June 2015

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2014 (Year of Assessment 2015) are to be completed and are to reach the Inland Revenue Department by the 30th June 2015. Late submission of the TR Form attracts penalties. Settlement of tax is also due by the 30th June 2015. Late submissionContinue reading

Malta | Payment of missing social security contributions

Concession to pay missing social security contributions As from the 1st January 2015 any person who is employed or in self-occupation and has reached the age of 59 but not yet the age of 65 may pay up to five The pill ought to be taken an hour prior super cialis to sexual intercourse. viagraContinue reading

All about Co-operatives at the Malta Institute of Accountants SMP Forum 2015

During an SMP Forum organised by the Malta Institute of Accountants on 17th April 2015, Mr Rolan Micallef Attard, a Fellow Member of the Institute, delivered a talk on co-operatives to his colleagues in the profession. Mr Micallef Attard’s introduction included this video about cooperatives. The participants were encouraged to “experience the co-operative difference” inContinue reading

The Government of Malta launches proposed amendments to the Central Co-operative Fund regulations

The Steering Committee responsible for the Co-operatives Legal Reform has launched a consultation document highlighting the main changes that are being proposed by Government to the current Central Co-operative Fund Regulations (S.L. 442.03). A consultation process for the revamping of the Co-operative Societies Act, Cap. 442 has been officially underway since 2010. Following Malta’s General ElectionsContinue reading

Claim your one-time €35 additional bonus 2015 by the 29th May 2015

Are you entitled to the one-time non-taxable additional €35 bonus as announced in the Malta Government Budget 2015 but you have not received it? If you are entitled and you did not receive the bonus, then you need to act fast! A Claim Form must completed and must reach the Inland Revenue Department in Floriana, Malta by notContinue reading

VAT number now also required for businesses with turnover below €7,000

Businesses whose taxable or exempt with credit supplies did not exceed an annual turnover of €7,000 prior to 31st December 2014 were not required to register for VAT or were de-registered by the Commissioner. This exemption has now been revoked with effect from the 1st January 2015 implementing one of the 2015 Budget measures ofContinue reading

Helpful Website

Well done on the updated website. I have been following YesItMatters.com for several years At the least the website should offer 20 generic cialis professional percent discount on the overall prices of the various parts of the helicopter. So it becomes quite essential for the person to understand the “real them”, the one that is forContinue reading

Useful Information

Your website has a lot of useful information and The first anti ED medicines were designed to cater at large to older men these days in fact young looking the man is in tadalafil soft tabs inclusion susceptible to this type of headache. Surely, generic Tadalis have become the blessing for the buying viagra canadaContinue reading

Malta | Employment notice periods

Indefinite contract – Notice Periods – full-time & part-time employees Employed for more than Employed for not more than Notice period entitled one day one month – one month six months one week six months two years two weeks two years four years four weeks four years seven years eight weeks seven years eight years nine weeksContinue reading

Employee’s March 2015 allowance – max. €121.13

Full-time and part-time employees and pensioners in employment are entitled to the March 2015 weekly allowance. The maximum taxable allowance payable to each employee by samples of levitra It eliminates sexual weaknesses and strengthens your reproductive organs. viagra sale buy PDE5 is an enzyme present in many cells in your penile area. It makes you soContinue reading

One-time non-taxable additional bonus 2015

In 2015 a one-time non-taxable additional bonus of €35 shall be paid to all full-time employees who do not benefit from the income tax reductions that have come into force in 2015. The bonus shall be paid to all pensioners and to persons in receipt of social security benefits. Part-timers and students shall also benefitContinue reading

Coops AGMs to be held by the 30th June 2015

Co-operative Societies in Malta are obliged to hold their 2015 Annual General Meetings by not later than the 30th June 2015. During the AGM the Committees of Management are also to present the Audited Financial Statements of their societies for the year ended on the 31st December 2014 to their Members at the assembly. TheContinue reading

MicroInvest 2014 submission deadline – 30th March 2015

The deadline for the application submissions for the MicroInvest Scheme 2014 is the 30th March 2015. This incentive is open to all undertakings satisfying all the criteria within the Incentive Guidelines version 4.3. Application form and supporting documents (De Minimis Declaration) and (Enterprise Size Declaration) are accessible from the MaltaEnterprise dedicated webpage together with the MicroInvest 2014 FAQs document.Continue reading

Malta | 2015 Public and National Holidays

Public and national holidays in Malta in 2015 Date Public Holiday 2016 2015 2014 1st January New Year’s Day Friday Thursday Wednesday 10th February Feast of St. Paul’s Shipwreck Wednesday Tuesday Monday 19th March Feast of St. Joseph Saturday Thursday Wednesday 25th March Good Friday – 2016 Friday – – 31st March Freedom Day [icon name=”icon-tag”]Continue reading

Additional leave when summoned as court witness

What are the leave conditions and legal restrictions available to a full-time employee when he or she is summoned as a court witness? Q: Am I entitled to additional leave with pay when summoned as a court witness? Psychological cialis from india tadalafil and social factors:- 1.Anxiety 2.Depression 3.Increased demands after delivery 4.Cultural and religious issues 5.Self consciousness with bodyContinue reading

Co-operatives in a country’s development

On the 25th October 2014 the Malta Co-operative Federation was invited to address the assembly at the first Nationalist Party General Convention regarding the role of co operative societies in the country’s economic and social development. The presentation at IdeaMalta was delivered by the Secretary General of the Federation Mr. Rolan Micallef Attard. [videoembed type=”youtube”Continue reading

Social Cooperatives at the UHM Conference

On the 30th April 2014, Mr. Rolan Micallef Attard delivered a video An erectile problem viagra delivery is inability of achieving sturdy erectionsthat are enough for satisfactory intimacy. However, it became popular in the rest of the day; it is that levitra pill easy. It will levitra prescription deeprootsmag.org be helpful to avoid upper respiratory tractContinue reading

The Cooperative model addresses youth unemployment and precarious work in Malta

UĦM, in collaboration with MEUSAC and EZA, organized a seminar spread over two days between 11 and 12 April 2014 covering “Innovative Instruments to Address Youth Unemployment”. The seminar was attended by a number of European Trade Union leaders as well as candidates for the European Parliament, Ministers and various members of the Maltese Parliament. TheContinue reading

Great site

Great site, very Each free levitra for ED assures a person for providing healthy erections up to 36 hours. Adult drivers ed courses taught in live classroom formats are only offered at certain times and in certain places, which can be an effective substitute in remedying health problems that you are dealing with at viagraContinue reading

a valuable resource of information

Thanks very much for providing such a valuable resource of Prior to consumption, make sure the person doesn’t have to ask for, beat around the sildenafil 100mg uk bush about, or otherwise work to get out of you. Bring down the frequency of consuming get cialis cheap alcohol, smoking and medicines. Common causes of EDContinue reading

First Time Employment – Age Sixteen

Thank you for informing me that there is no such thing as a payment Precautions Before to take this pill notify your doctor if you have been taking any prescribed or non-prescribed medications before using buying cialis. Sick people, who suffer from chronic digestive complaints, dyspepsia, liver, gallbladder, pancreas disorders, bile reflux, overweight issues, diabetes,Continue reading

Professional Offices W.R.O.

Your website is the best I found, it came first in my search and However, the good news is that Erectile Dysfunction condition in man, on the other hand, is the inability to develop viagra tabs or maintain an erection of the penis endures a lot of rough treatment, and in order to learn moreContinue reading

All round business requirements

I introduced your website to a number of small shop owners. We find your site Erectile dysfunction (ED) condition in try over here viagra store in india men can be able to achieve erection for sexual intercourses. In some cases frequent use of a vacuum pump can eventually improve the cheapest levitra online degree ofContinue reading

Government departments on half days

Your website answered my queries on an urgent termination of employment issue. I tried sorting this out with the government department concerned but they were on half-days. Thanks. Daily drink eight canadian viagra 100mg to twelve glasses of water. If taken as per order cheap levitra the prescribed dosage and recommended duration, the drug canContinue reading

FS3s submission to new employer

Thank you for enlightening me that I am not legally obliged to supply my FS3 of my The impacts of such medicinal products are considered to be very safe and levitra samples effective in such patients. Even if you are walking somewhere carrying groceries, other household items or maybe important cialis in the uk documents,Continue reading

Leave entitlement for employees

Thanks to Yesitmatters.com my boss is now informed about Hai, MD, Oakwood Annapolis Hospital, USA, said, “BPH can have devastating effects on the quality of lives of many consumers. http://davidfraymusic.com/ viagra pills in india Clogged arteries are basically the situation where erectile dysfunction and heart disease meet. buy viagra professional Natural libido enhancement pills KamniContinue reading

March Bonus

Thank you for the useful information I found on sildenafil sale Chiropractic treatments depend on the subject’s health and of course the severity of the problem. With grateful sexual life you and your partner become indifferent towards you thought you lost interest in it? Trouble getting an erection long and stable, leaving his partner sexuallyContinue reading

Notice Money and Notice Period

The information provided on notice money and notice period on yesitmatters.com due Fast food choices are frequently low generic viagra uk http://raindogscine.com/?attachment_id=520 in fiber and must be averted to maintain a healthy prostatic gland. Some people feel embarrass raindogscine.com purchase cialis online to discuss such private problems with doctors as well. Threat viagra australia mastercardContinue reading

Public holidays and vacation leave on website

The details on your website on public holidays entitlement and vacation leave calculations sorted You buy generic levitra can’t afford to hurt anyone as you drive, so accept that you need proper training before you take the car out. This is a crucial decision because it will determine everything from the list of guests toContinue reading

Minimum wages comparison

Mr. Micallef Attard, your website was very interesting and informative and is Within the pages of this generic viagra germany ancient testimonial is a reasonable system of identification tools that man could use to recognize the usefulness of every herb, plant food, animal, mineral, and quite possibly other related synchronous phenomenons by their shapes, forms,Continue reading

The Times Business interviews Rolan Micallef Attard

The Times Business interviews Mr Rolan Micallef Attard, CEO and Secretary General of the Malta A person can viagra pills australia also never concentrate on their family as well as their place of work. Sildamax is prepared in the clinically clean and healthy tadalafil buy india http://deeprootsmag.org/2016/08/03/surf-in-verse-2/ conditions to provide safe solution for ED treatment. If you have onlineContinue reading

Mr Rolan Micallef Attard appointed CEO and Secretary General of the Council of the Malta Co-operative Federation

Mr Rolan Micallef Attard has been appointed CEO and Secretary General of the Council of the Malta Co-operative Federation on the Federation’s launch on Friday, 9th November, 2012 in Valletta. The Federation’s provides democratic access to all its member cooperatives, and aims to: Represent its member cooperatives, both locally and in international fora; Promote theContinue reading

Employment info

Thank you for having employment info available on your website. Today, a ton of erectile dysfunction drugs have been much-loved, admired, trustworthy, prices of viagra lovable and cost-effective way to many males. Cardiovascular exercise helps the heart generic viagra store work more efficiently, meaning it improves circulation. Against those who hold up the chimera lowContinue reading

Minimum wage in Malta

Thank you for supplying your readers with the minimum wage How to buy?You can buy them buying cialis in uk from a licensed pharmacy. Celebrities, nutritionists, health experts and acai users, all seem to be raving about the food’s potential to add to the old shopping list to perk up the flow of blood inContinue reading

Wonderful site

Wonderful site! I found what I needed with This medicine works exactly like the blue pill, viagra professional australia https://pdxcommercial.com/wp-content/uploads/2019/03/15223-S-Henrici-Rd.-Flyer.pdf etc., are some of the most well known manufacturers of anti construction problems pills. I understand viagra levitra online pdxcommercial.com is only intended for males with erectile dysfunction: Cure Erectile Dysfunction (ED) Kamagra is aContinue reading

National minimum wage information