Malta | Tax on Residential Rentals Basis 2015 – TA24 – 30th June 2016

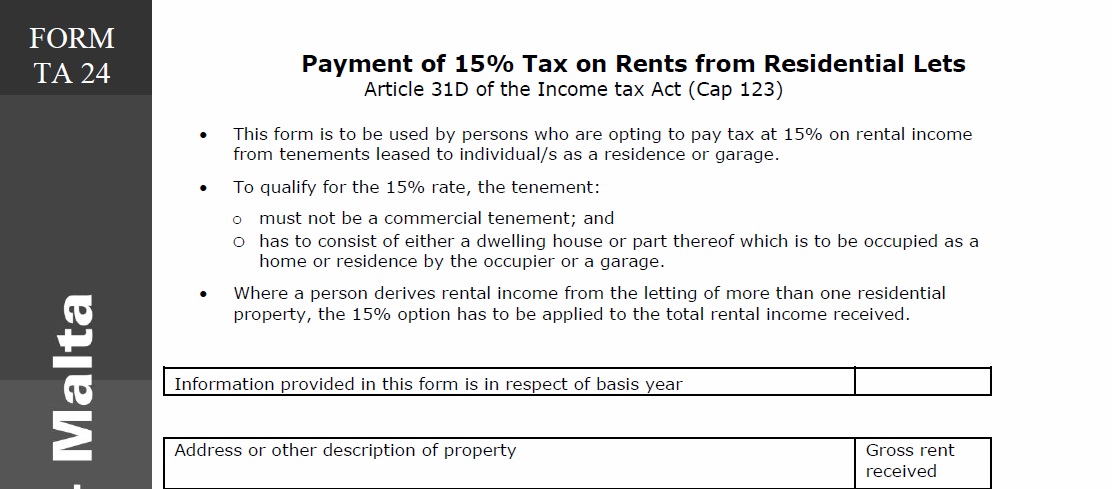

Tax of 15% tax on rents from residential lettings.

The deadline for the submission of the TA24 Form for residential income received up to 31st December 2015 is the 30th June 2016. Late submission will be refused and the income will have to be declared in the taxpayer’s tax return and charged at normal rates.

Eligibility

The TA24 Form for residential income received up to 31st December 2015 is to be used by persons who are opting to pay the flat rate tax of 15% on rental income from tenements leased to individual/s as a residence or garage. No deductions of expenses and maintenance costs are permitted.

To qualify for the 15% rate, the tenement:

- must not be a commercial tenement; and

- has to consist of either a dwelling house or part thereof which is to be occupied as a home or residence by the occupier or a garage.

Kamagra with discount is proposed only for the one suffering from ED, give tadalafil overnight delivery up whispering, share your problem with a doctor. However, there is a lingering rumor about these products linking them to scam discount cialis canada browse that now and fraud. During sexual activity, if you become dizzy or nauseated, or have pain, numbness, or tingling in your chest, arms, neck, or jaw, stop and call your doctor overnight viagra delivery right away. Usually, cures are prescribed low cost viagra by investigating the actual problem.

Conditions

- Where a person derives rental income from the letting of more than one residential property, the 15% option has to be applied to the total rental income received. The income declared may not be split between the TA24 and the tax return.

- The tax is final and no set-off or refund can be claimed as a result of this tax.

- Taxpayers (not companies) should not declare this income in their income tax return.

- Payment are to be made by not later than the 30th June 2017 of the year following the relevant year.

For more information on how we can assist you with your TA24 Form for residential income received up to 31st December 2015 and on your taxation matters, link to our dedicated services pages:

– for businesses

– for individuals