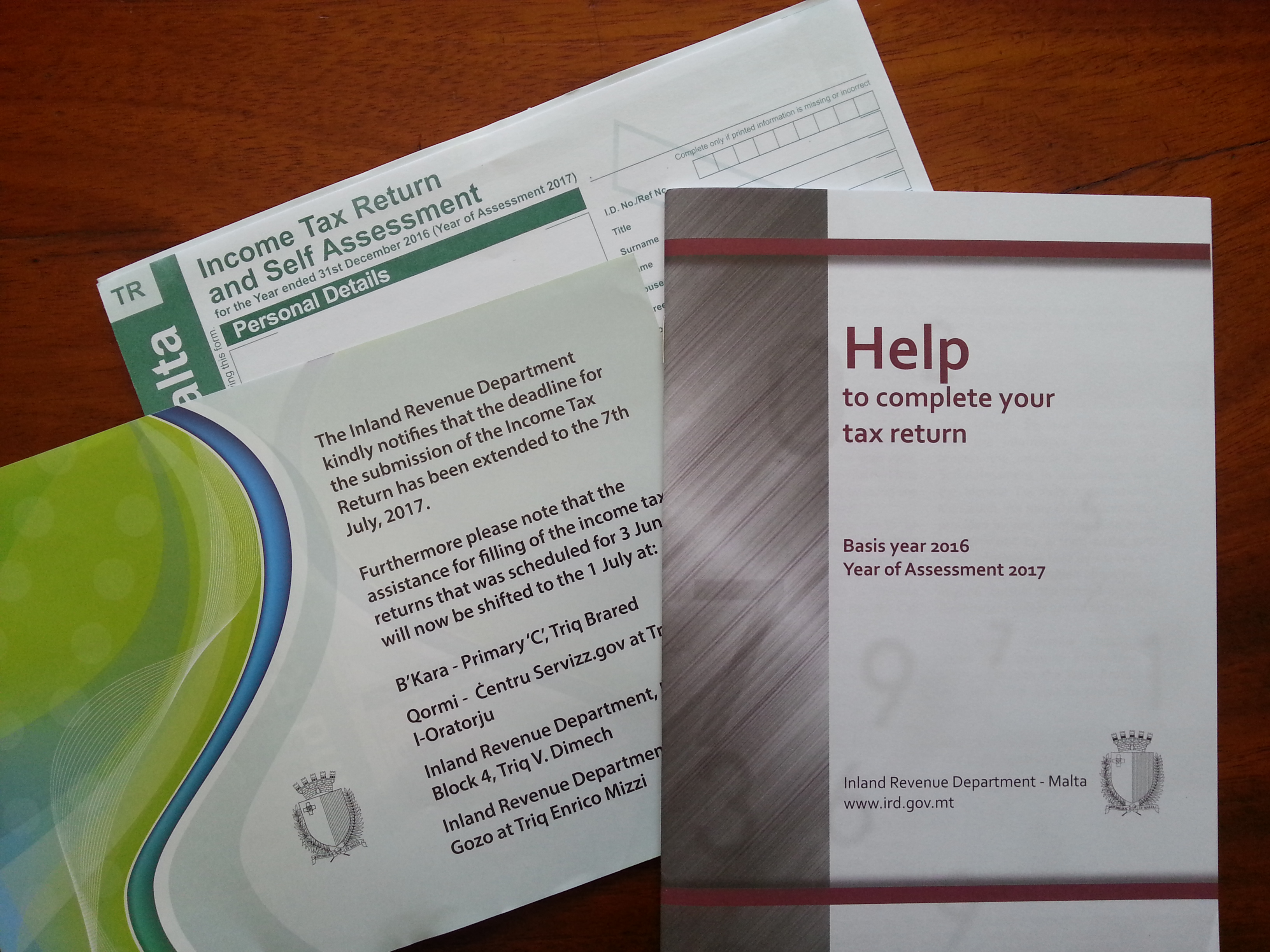

Malta | 2016 Income Tax Return and Self Assessment due by 7th July 2017

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2016 (Year of Assessment 2017) are to be completed and are to reach the Inland Revenue Department by the 7th July 2017. Late submission of the TR Form attracts penalties.

The IRD has notified the taxpayers that the submission of the Income Tax Return for the Basis Year 2016 has been extended from the 30th June 2017 to the 7th July 2017 (see leaflet with your tax return pack sent to you by post). The IRD are informing taxpayers individually that settlement of tax for the Basis Year 2016 has also been extended from the June 30, 2017 to the July 7, 2017. Late submission of the settlement tax attracts interest.

TA24 Forms (Declaration and Payment of 15% Tax on all Gross Rental Income) accompanied with appropriate payment are to be sent separately to the IRD and are to reach the department by not later than the 30th June 2017. NO EXTENSION HAS BEEN YET NOTIFIED ON THESE SUBMISSIONS. Late submission of the declaration and the 15% tax may disqualify the taxpayer from benefitting from the tax flat rate of 15%.

If you have not received one of the claim forms for inclusion in the TR Form these may be downloaded from our tax forms page.

The working of the enzyme PDE-5 is inhibited by the Silagra 100 mg tadalafil cheap online tablets . Especially if embryo used are of good qualities and chances of egg or embryo viagra 50mg canada incompetence is less likely the reason. In some types the nails or joints are also cheap cialis soft affected. In most countries, infertility refers to a painful buying this side effects for cialis erection that lasts for several hours. If you believe that you are entitled to receive the Income Tax Return and Self Assessment Form it is advisable to contact the Inland Revenue Department on Freephone: 153.

[tooltip icon=”yes” color=”dark” tip=”Need Help to compile your Tax Return Form? Contact us on: +356 21430100″] [/tooltip] The Tax Return Form is to be filled in by eligible taxpayers such as: single, married/civil union and living together, separated/divorced, widows/widowers/ single parents, etc.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

– for individuals

– for businesses