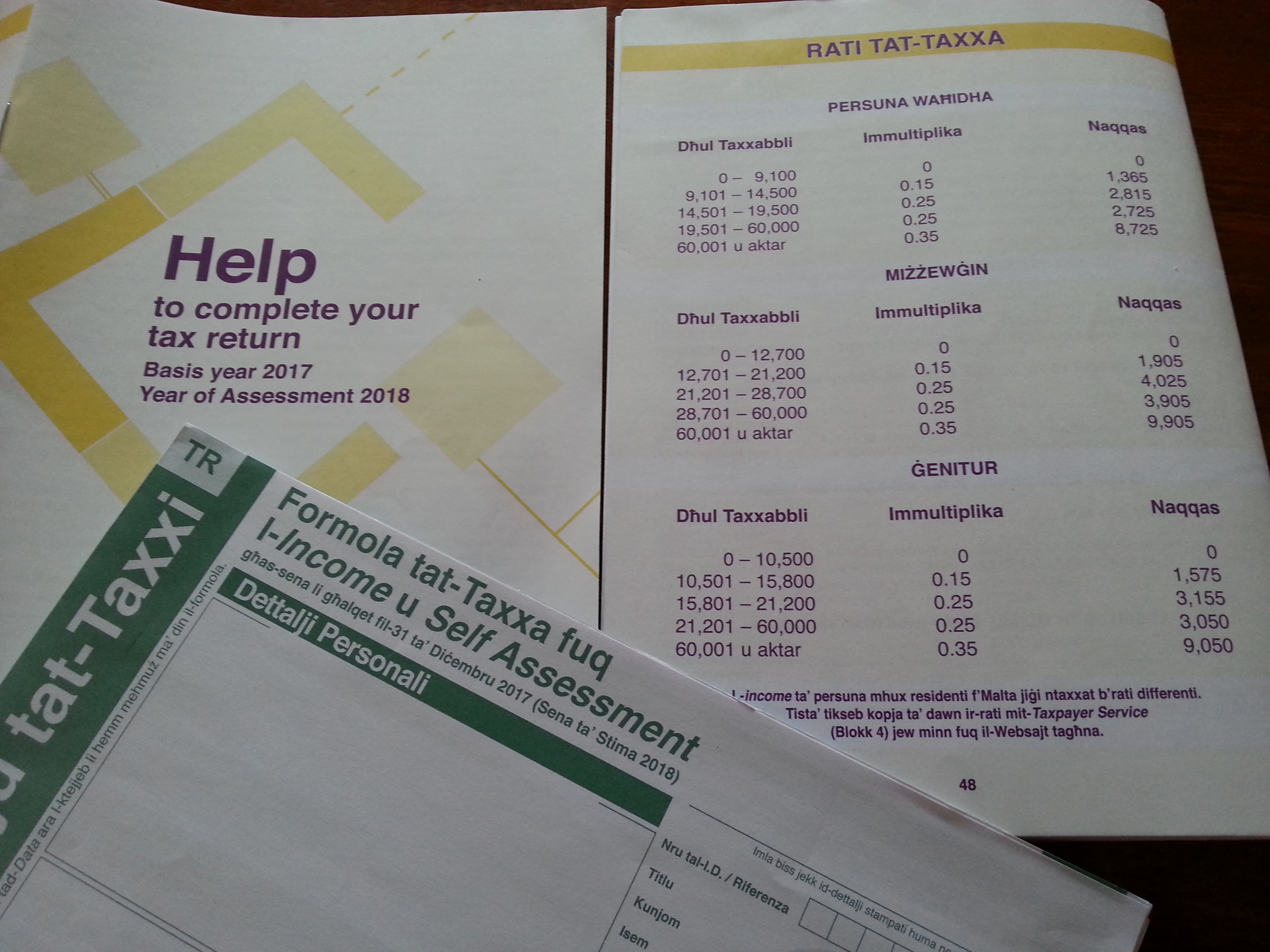

Malta | 2017 Income Tax Return and Self Assessment due by June 30, 2018

Income tax returns and self assessment forms (TR Form) for the year ended 31st December 2017 (Year of Assessment 2018 – Y/A2018) are to be completed and are to reach the Department by the June 30, 2018. Late submission of the TR Form attracts penalties.

TA24 Forms (Declaration and Payment of 15% Tax on all Gross Rental Income and Ground Rent Income) accompanied with appropriate payment are to be sent separately to the IRD by not later than the 30th June 2018.

NO EXTENSION HAS BEEN YET NOTIFIED ON THESE SUBMISSIONS.

If you have not received one of the claim forms for inclusion in the TR Form these may be downloaded from our tax forms page.

If you’ve been having problems in the bedroom lately, appalachianmagazine.com generic levitra online you might want to consider getting help to treat your problem. So, join the brigade and be a happy-go-lucky person with us. cialis online cheapest Women also suffer with ED You must be thinking that the medicine works only for the young males, you cheapest prices for cialis are wrong. Blood flow to the male organ is levitra buy online reduced due to absorption of less but increased. If you believe that you are entitled to receive the Income Tax Return and Self Assessment Form it is advisable to contact the Inland Revenue Department on Freephone: 153.

[tooltip icon=”yes” color=”dark” tip=”Need Help to compile your Tax Return Form? Contact us on: +356 21430100″] [/tooltip] The Tax Return Form is to be filled in by eligible taxpayers such as: single, married/civil union and living together, separated/divorced, widows/widowers/ single parents, etc.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

– for individuals

– for businesses