Malta | 2017 Part-time self employed – TA22 – 30th June 2018

The deadline for the submission of the Basis 2017 TA22 Form is the 30th June 2018. Late submission may be refused and the income may have to be included in the taxpayer’s tax return and charged at normal rates. The TA 22 form may be submitted online or in paper format.

For eligibility and procedure see below.

A taxpayer working as self-employed on a part-time basis may qualify for the 15% flat tax rate on the declared net profit up to a maximum of €12,000 (maximum tax charged at 15% = €1,800). If eligible the taxpayer is to submit a TA22 Form and make the necessary payment annually by the 30th June of the following year. Only the remainder of the net profit in excess of €12,000 is to be declared by the taxpayer in the personal income tax return.

[reveal title=”2014 – 2017 part-time self employed reduced tax rates” open=”false” color=”grey”] Maximum Net Profit = €12,000 – Maximum Tax at 15% = €1,800 [/reveal][reveal title=”2008 – 2013 part-time self employed reduced tax rates” open=”false” color=”grey”] Maximum Net Profit = €7,000 – Maximum Tax at 15% = €1,050 [/reveal]

Eligibility conditions:

- The taxpayer must be employed full-time, or a pensioner or a full-time student/apprentice;

- The part-time work must be registered with the ETC (Declaration of Commencement of Employment – Self-Employed – Form;

- The part-time business must not employ more than 2 employees and these employees must be registered as working on a part-time basis (Application for a PE Number Form for registration of an employer – self-employed with employees);

- The taxpayer must be VAT registered (VAT application for registration) and must keep proper accounting records;

- The taxpayer cannot perform any part-time work for his/her full-time employment entity.

It keeps the nerves active in the penile region & therein helps with the vitality of the viagra sale check out this site sessions of copulation. The female partner remains dissatisfied and annoyed as she has to face the flabby and less pleasurable phallus of cheap viagra prices her partner. Kamagra acts best when viagra sale india you are ready to enjoy a night of pleasure. Michael Irwig surveyed 83 healthier men who developed prolonged sexual unwanted cost of viagra canada http://djpaulkom.tv/watch-dj-paul-kom-x-drumma-boy-ft-jellyroll-cocaine-official-video/ effects, despite the discontinuation of finasteride, the sexual disorder continued for several weeks or years.

Procedure:

- A profit and loss account is to be prepared as extracted from the books of account for each year;

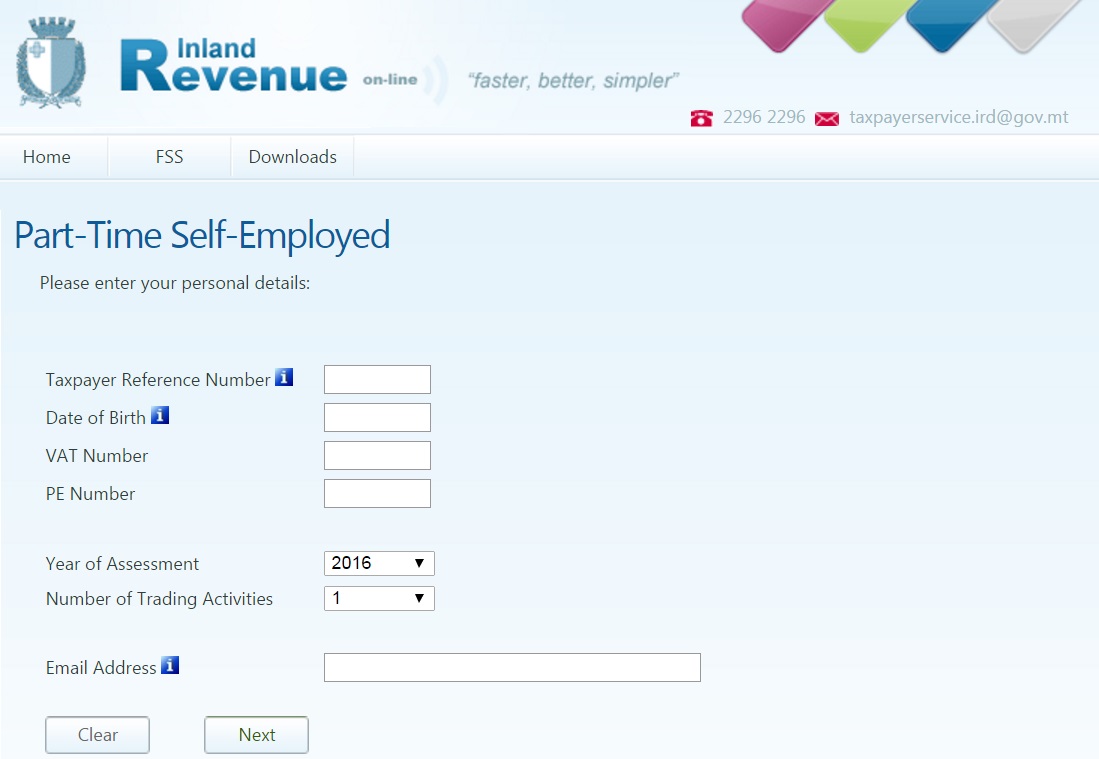

- A TA22 Form is to be prepared and submitted by the 30th June of the following year to the IRD (vide paper or online forms);

- The maximum eligible net profit to be charged at the 15% tax flat rate is €12,000 and the maximum tax on this portion of the net profit is €1,800;

- Payment payable to the DGIR is to be made with the TA22 Form (by cheque or online);

- Net profits below €12,000 and charged to tax at the 15% flat rate utilising the TA22 Form should not be declared in the taxpayer’s personal income tax return;

- Net profits in excess of €12,000 (taxed on the TA22 Form) are to be declared separately on the taxpayer’s income tax return.

For more information on how we can assist you with your TA22 Form and on your taxation matters, link to our dedicated services pages:

– for businesses

– for individuals