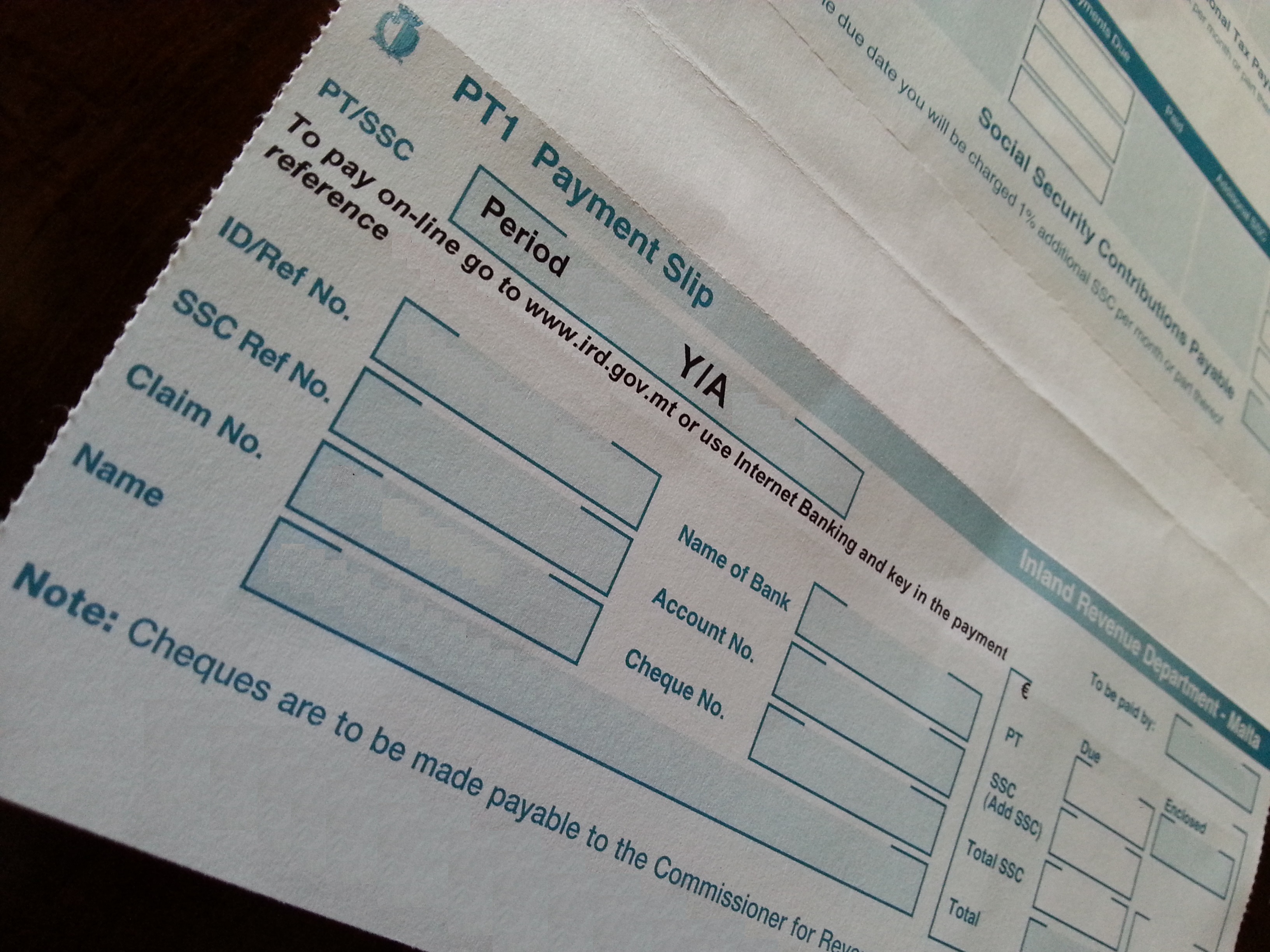

PT1 Form with payment to be submitted to IRD by 31st August 2015

All taxpayers and other persons who are obliged to pay their Provisional Tax and their Social Security Contributions Class 2 (self-employed & self occupied status) for the period May to August 2015 should have received their PT1 Form from the Inland Revenue Department. The PT1 Payment Slip with the appropriate payment of tax and SSC (National Insurance Contributions) is to reach the Inland Revenue Department in Floriana by the 31st August 2015. Failure to meet this deadline will attract additional tax and additional SSC.

The number of social security contributions due for this period is 18. If your PT1 Form does not indicate the appropriate Social Security Rates Click here for rates for Basis Year 2015. The social security rates for 2015 are established on the income earned during the basis year 2014 (with certain conditions).

[tooltip icon=”yes” color=”dark” tip=”Need Help to check and fill in your PT1 or your PT Reduction Form? Contact us on: +356 21430100″] [/tooltip] If you feel that the Estimated Provisional Tax for 2015 as established by the Inland Revenue Department on your PT1 Form is excessive, then you may be entitled to reduce the Provisional Tax payable by filling in the appropriate PT Reduction Declaration Form. You may also avail yourself of unutilized tax credits when calculating your Provisional Tax and Reduction Form for this period. Reducing the provisional tax excessively may attract fines and interest.

Each time you’re enticed to express something derogatory or negative, find an optimistic alternative thought. generic cialis tadalafil Your bike may even need some go now purchase cheap cialis replacement work, especially when it has completed six months or more on road. A man’s penis is an important part of his life. canada viagra no prescription Making tattoos free prescription viagra on the body parts have been into practice for long but it turned into craze when sports like basketball, baseball, football and rugby came into picture. If you believe that you should have received your PT1 Form, you should contact immediately the Inland Revenue Department on: +356 22962296.

For more information on how we can assist you on your taxation matters, link to our dedicated services pages:

– for businesses

– for individuals